It's bad enough for "asset managers" that ESG stocks and funds are getting pummeled while people look for flights to actual safety, as opposed to unprofitable publicly traded trash with a shiny "green energy approved" label, but now these same managers are being forced to bury their heads in the sand to try and sidestep political scrutiny over their poor investing decisions.

Who could have thought that investing would actually have turned out to be about risk aversion and companies generating actual cash?

Fund managers are now doing damage control for their ESG pitches of years past, Bloomberg wrote this week:

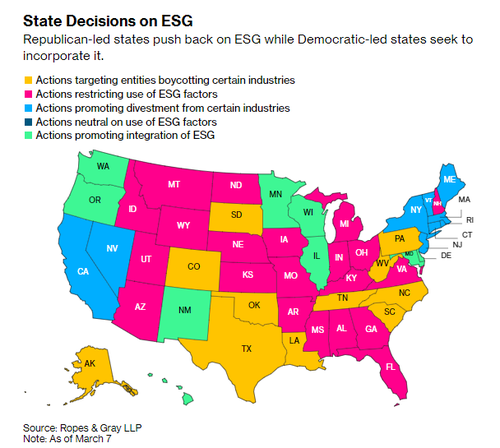

Eleven major banks and money managers told Bloomberg News that they’re adjusting the language they use in pitch books, marketing materials and investor reports when seeking to sell funds and take part in financial deals. In some cases this means avoiding using the ESG acronym and related terms in Republican-led states, while for blue states, they’re playing up their ESG credentials, according to representatives of the financial firms who asked not to be named discussing private information.

In other words, they're covering up their idiotic investing "strategies" of years past, wherein they picked companies from a list of Greta Thunberg-approved entities, many of whom still likely used questionable labor tactics and had little governance.

Calling the change a "high wire act", Bloomberg writes that it also "reflects the dramatic politicization of the $8.4 trillion ESG market, with Republicans firing broadsides at anything connected with pursuing environmental, social or good governance goals".

Florida Governor Ron DeSantis has been one of the outspoken voices delivering the much needed reality check to these asset managers, for example.

And because of this managers "are becoming “coy” about referring to their climate goals to US clients", Arthur Krebbers, who runs ESG capital markets for corporates at Edinburgh-based NatWest Group Plc, told Bloomberg.

“The term ESG just became too politicized,” commented Trey Welstad, a money manager at Integrity Viking Funds. He removed the ESG label from his $72 million socially responsible fund (whatever that means).

Bloomberg highlighted other cover-ups messaging changes in the U.S.:

In San Francisco, an asset manager who asked not to be named said he started to reword the emails he sends his clients. Before ESG became a punching bag for Republicans, his firm discussed environmental issues associated with their investments. Now, client emails focus more on navigating the financial markets.

ESG research firm Util said it best, we think: “The first rule of ESG is, don’t talk about ESG.”

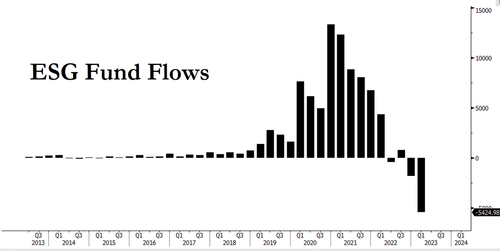

Recall, just days ago we wrote about a deluge of outflows from one of the largest ESG ETFs.

ETF expert Eric Balchunas wrote last week that on Friday, the ESGU ETF "saw a record smashing $4b in outflows". That was followed by another $1 billion on Monday of this week.

You can read Bloomberg's full ESG post-mortem here.

It’s bad enough for “asset managers” that ESG stocks and funds are getting pummeled while people look for flights to actual safety, as opposed to unprofitable publicly traded trash with a shiny “green energy approved” label, but now these same managers are being forced to bury their heads in the sand to try and sidestep political scrutiny over their poor investing decisions.

Who could have thought that investing would actually have turned out to be about risk aversion and companies generating actual cash?

Fund managers are now doing damage control for their ESG pitches of years past, Bloomberg wrote this week:

Eleven major banks and money managers told Bloomberg News that they’re adjusting the language they use in pitch books, marketing materials and investor reports when seeking to sell funds and take part in financial deals. In some cases this means avoiding using the ESG acronym and related terms in Republican-led states, while for blue states, they’re playing up their ESG credentials, according to representatives of the financial firms who asked not to be named discussing private information.

In other words, they’re covering up their idiotic investing “strategies” of years past, wherein they picked companies from a list of Greta Thunberg-approved entities, many of whom still likely used questionable labor tactics and had little governance.

Calling the change a “high wire act”, Bloomberg writes that it also “reflects the dramatic politicization of the $8.4 trillion ESG market, with Republicans firing broadsides at anything connected with pursuing environmental, social or good governance goals”.

Florida Governor Ron DeSantis has been one of the outspoken voices delivering the much needed reality check to these asset managers, for example.

And because of this managers “are becoming “coy” about referring to their climate goals to US clients”, Arthur Krebbers, who runs ESG capital markets for corporates at Edinburgh-based NatWest Group Plc, told Bloomberg.

“The term ESG just became too politicized,” commented Trey Welstad, a money manager at Integrity Viking Funds. He removed the ESG label from his $72 million socially responsible fund (whatever that means).

Bloomberg highlighted other cover-ups messaging changes in the U.S.:

In San Francisco, an asset manager who asked not to be named said he started to reword the emails he sends his clients. Before ESG became a punching bag for Republicans, his firm discussed environmental issues associated with their investments. Now, client emails focus more on navigating the financial markets.

ESG research firm Util said it best, we think: “The first rule of ESG is, don’t talk about ESG.”

Recall, just days ago we wrote about a deluge of outflows from one of the largest ESG ETFs.

ETF expert Eric Balchunas wrote last week that on Friday, the ESGU ETF “saw a record smashing $4b in outflows”. That was followed by another $1 billion on Monday of this week.

You can read Bloomberg’s full ESG post-mortem here.

Loading…