By Michael Msika, Bloomberg Markets Live reporter

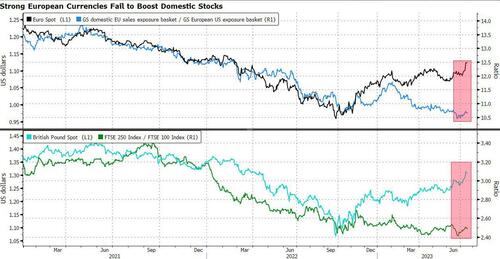

Europe’s currencies are hitting multi-month highs as the US dollar takes another leg lower. While that’s bad news for exporters, it’s not even helping domestic stocks much.

Since last September’s low, the euro has surged over 17% against the dollar, marking a 17-month high. The pound and the Swiss franc have also soared. Yet a basket of shares with exposure to EU sales has lagged the single currency, with the trend similar in the UK.

“The euro is up for the wrong reasons,” says Barclays strategist Emmanuel Cau. While a strong euro is typically an indicator of positive sentiment, the move this time is driven by higher rates rather than better economic growth, he notes. Equity flows show investors favor the US over Europe, while the gap in relative economic surprises is likely at an extreme, he says.

“One of the reason for the breakdown of relationship between domestic stocks and the currency is that the European economy has been quite weak, we’ve had a technical recession in Europe, the manufacturing data is still very weak,” says Goldman Sachs strategist Sharon Bell, adding a catch-up will depend on the improvement of the economic data. Bell also points out most domestic stocks don’t benefit from the AI trend secular drive, and some domestic sectors like telecoms and utilities suffer from high rates given their elevated debt levels.

Given Europe’s export-heavy stock market, strong domestic currencies on average hurt profits in the region. In a model based on year-on-year figures and with all else equal, Barclays estimates that euro-area earnings will take a 2.5% hit from the stronger single currency.

The greenback has been weakening for 10 months, and the latest leg lower — fueled by bets that cooling inflation will usher in an end to Federal Reserve interest-rate hikes soon — may exacerbate trends seen so far. Dollar-exposed sectors like health-care have underperformed, while cyclical sectors have led gains.

While most of the impact of a weaker dollar may not yet be felt in second-quarter results, companies such as luxury-goods makers Swatch and Burberry have recently warned of currency headwinds. Outlook statements and analyst calls during the earnings season may offer more clues on the impact this year.

Looking ahead, European winners from a strong local currency are hard to identify, says Bloomberg Intelligence strategist Laurent Douillet, but adds that losers are likely to be health care, consumer-related sectors and industrials.

Strategists such as Bank J. Safra Sarasin’s Wolf von Rotberg say that the dollar’s reversal is a “temporary development.” He expects a global and US slowdown toward the end of 2023 or early 2024 to potentially strengthen the dollar again. In that scenario, health-care shares and Switzerland, whose stock benchmark has a heavy weighting of the sector, would benefit the most, he adds. In the meantime, a weak greenback may help sectors like miners and oil as it tends to support commodities, von Rotberg says.

For Syz CIO Charles-Henry Monchau, the weakness in the dollar could spur some rotation toward EM assets and commodity-related stocks. “Let’s not forget that the dollar is a risk off currency and currently we are risk on,” he says.

By Michael Msika, Bloomberg Markets Live reporter

Europe’s currencies are hitting multi-month highs as the US dollar takes another leg lower. While that’s bad news for exporters, it’s not even helping domestic stocks much.

Since last September’s low, the euro has surged over 17% against the dollar, marking a 17-month high. The pound and the Swiss franc have also soared. Yet a basket of shares with exposure to EU sales has lagged the single currency, with the trend similar in the UK.

“The euro is up for the wrong reasons,” says Barclays strategist Emmanuel Cau. While a strong euro is typically an indicator of positive sentiment, the move this time is driven by higher rates rather than better economic growth, he notes. Equity flows show investors favor the US over Europe, while the gap in relative economic surprises is likely at an extreme, he says.

“One of the reason for the breakdown of relationship between domestic stocks and the currency is that the European economy has been quite weak, we’ve had a technical recession in Europe, the manufacturing data is still very weak,” says Goldman Sachs strategist Sharon Bell, adding a catch-up will depend on the improvement of the economic data. Bell also points out most domestic stocks don’t benefit from the AI trend secular drive, and some domestic sectors like telecoms and utilities suffer from high rates given their elevated debt levels.

Given Europe’s export-heavy stock market, strong domestic currencies on average hurt profits in the region. In a model based on year-on-year figures and with all else equal, Barclays estimates that euro-area earnings will take a 2.5% hit from the stronger single currency.

The greenback has been weakening for 10 months, and the latest leg lower — fueled by bets that cooling inflation will usher in an end to Federal Reserve interest-rate hikes soon — may exacerbate trends seen so far. Dollar-exposed sectors like health-care have underperformed, while cyclical sectors have led gains.

While most of the impact of a weaker dollar may not yet be felt in second-quarter results, companies such as luxury-goods makers Swatch and Burberry have recently warned of currency headwinds. Outlook statements and analyst calls during the earnings season may offer more clues on the impact this year.

Looking ahead, European winners from a strong local currency are hard to identify, says Bloomberg Intelligence strategist Laurent Douillet, but adds that losers are likely to be health care, consumer-related sectors and industrials.

Strategists such as Bank J. Safra Sarasin’s Wolf von Rotberg say that the dollar’s reversal is a “temporary development.” He expects a global and US slowdown toward the end of 2023 or early 2024 to potentially strengthen the dollar again. In that scenario, health-care shares and Switzerland, whose stock benchmark has a heavy weighting of the sector, would benefit the most, he adds. In the meantime, a weak greenback may help sectors like miners and oil as it tends to support commodities, von Rotberg says.

For Syz CIO Charles-Henry Monchau, the weakness in the dollar could spur some rotation toward EM assets and commodity-related stocks. “Let’s not forget that the dollar is a risk off currency and currently we are risk on,” he says.

Loading…