Authored by Kane McGukin via BombThrower.com,

We’ve seen this movie before. This version is the battle of digital gold over power regimes past their prime.

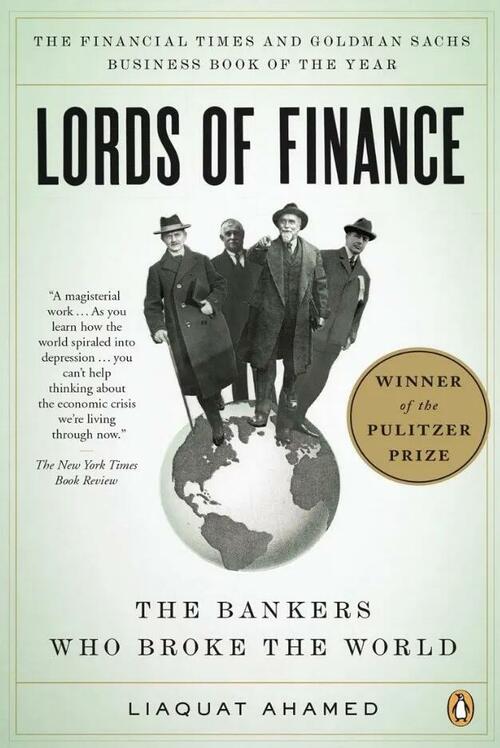

In the early 1900’s, specifically in the 1920s, Benjamin Strong orchestrated deals around the world to have leaders send their gold to the United States for “safe harbor” and to balance capital flows for the “safety” of the system. In hindsight, this power play put the US at the center of an emerging fiat currency-based monetary system. One was built on the backs of US industrial capitalists, financed through international political friendships, and by way of war; conflicts in capital markets, and hand-to-hand combat. This intelligent move placed the US at the helm of our global monetary system.

As the chess board tilted, tensions rose and global wars broke out.

Some countries stood in the shadows funding by proxy, while others shot from the trenches in hopes of preserving their political views of how future power structures should look. As the web of relationships untangled global capital flows, it reordered the holders of power and money strewn across the monopoly board. Countries made calls to the US to have their gold returned. To appease, Team Strong made many overseas visits and promises to ensure their gold was in safe hands. However, the US rarely returned the base capital asset, leaving others in a jam.

Upon Strong’s death, no one knew the inner workings of his plan. Nor did they have his deep global political persuasion and ties to carry it on any longer. Without Strong’s skill as a puppeteer, world financial markets and its political players found themselves in a precarious situation. Leading to the greatest ravaging experienced in some time. The Great Depression was an event unlike any other. Leaving no stone unturned as it traveled across the globe. Only to finally end in one great global war (WWII). The ending of 31 years of financial, economic, and military might, shuffled the decks and set the table for a new monetary regime guided by a Bretton Woods system of currency pegs. All money movements now hinged on gold stashed in vaults within US borders, while opposing the views and warnings of Triffin’s Dilemma.

As anger subdued and tensions came down, the fix was in. Realignment was in order so that Bretton Woods could provide all parties access to money once again. The monopoly board was set for another round of play. New leaders, deals, and tiers of countries to shape a new level of understanding as to how the game would be played. The ground rules established how a new currency system would work.

An old story this is, though it sounds all too familiar when relating it to our current state of international and monetary affairs. Once again, finding ourselves at a societal inflection point.

Caught Between the Throws of Money and A Few Men’s Greed.

Reflecting on our past highlights the critical importance of understanding the value of sound money assets. These assets are essential for advancing to a digital monetary system that powers our modern lives—a transition that requires time and a complete shift in thinking.

The Kings and pawns alike are seeking access to new rules and a new monetary base that will provide power and control for the next 100 years. Citizens watch over streams of media as major political players battle behind closed doors. From X (formerly Twitter), to Meta (formerly Facebook), Tiktok and Nostr, pitches are crafted for the open airwaves of the internet. Each side casts memes and propaganda across every news and social media network intending to shape the minds of the next generation of leaders. What’s the goal? Just the same as it was in the early 1900s, the intention is to corner the free market of money and power.

“A man generally has two reasons for doing a thing. One that sounds good, and a real one.”

– JP Morgan

Over the span of the last 20 years our battles have become increasingly cyber in nature. As a result of these conflicts, we’ve seen Bitcoin move like gold of the past. We’ve watched Bitcoin Hashrate migrate from China to the US, where exchanges like Coinbase, Gemini, and Kraken have been constructed to power the future of money, rates, lending and barter across the bits and bytes of our internet pipes.

The Fix for the Next Round of Global World Order Is Almost In.

Big banks, technocrates, Wall Street, and political clout are all jostling for their version of how the future should be told. The difficulty adjustment continues to ratchet as the momentum of our new market places shift.

The transition from guns and army’s to a world of bots and DDOS attacks took time to run its course.

What started with credit cards and advanced technology research projects at the Defense Advanced Research Projects Agency (DARPA) in 1958, led us to the internet, protocols, and partial means of transferring digital money by consensus. With the rise of information and consumer technology, we found ourselves in a digital ecosystem with limited access or control of our money. This new revolution in the digital age gave way to industrial ideals and promoted a shift to a more connected and intelligent world.

As foundations for a new digital financial system have been laid, global relationships were infiltrated as new players emerged. Shifting from ideals of our past monetary fathers, Benjamin Strong (US), Montagu Norman (England), Hjalmar Schacht (Germany), Emile Moreau (France) to new forms of intelligence guided by The Five Eyes (US, UK, Canada, Australia, New Zealand).

When we crossed the chasm of the 21st Century, powers shifted. E-commerce and social platforms steered the attention of business and consumers in such a way that new tools for psychological research were necessary to keep up. From this state of need, the Intelligence Advanced Research Projects Activity (IARPA – 2007) was born to pick up where DARPA left off.

As populations warmed to the ideas of digital scarcity; Bitcoin has risen. Playing the role of the fastest horse for sending sound money over our internet rails. With the momentum of the race shifting, nations are back to warring again. Leading to citizenry shouts of spooks and kooks against anyone attempting to triangulate their location and affiliation.

At this juncture the board is set for players to make their move. A few critical questions should be asked. The answers will dictate the freedoms or draconian measures that follow.

-

What Bitcoiner is playing the role of Ben Strong?

-

What Bitcoin influencers are Norman, Schacht, and Moreau?

-

Has the Digital Bretton Woods conference taken place? If not, then when and what parties will be invited to attend?

These are the private keys that will decide our future. The future of money, power, and control.

New terms and players will dictate the price of properties, utilities, and digital rails that will be traded so we can all transact in a civilized manner. This is a new story with new faces, technologies, and tools. However, it is the same story of money that spans across human history. One that repeats in unison with the 4th Turnings that dictate our times.

* * *

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.

Authored by Kane McGukin via BombThrower.com,

We’ve seen this movie before. This version is the battle of digital gold over power regimes past their prime.

In the early 1900’s, specifically in the 1920s, Benjamin Strong orchestrated deals around the world to have leaders send their gold to the United States for “safe harbor” and to balance capital flows for the “safety” of the system. In hindsight, this power play put the US at the center of an emerging fiat currency-based monetary system. One was built on the backs of US industrial capitalists, financed through international political friendships, and by way of war; conflicts in capital markets, and hand-to-hand combat. This intelligent move placed the US at the helm of our global monetary system.

As the chess board tilted, tensions rose and global wars broke out.

Some countries stood in the shadows funding by proxy, while others shot from the trenches in hopes of preserving their political views of how future power structures should look. As the web of relationships untangled global capital flows, it reordered the holders of power and money strewn across the monopoly board. Countries made calls to the US to have their gold returned. To appease, Team Strong made many overseas visits and promises to ensure their gold was in safe hands. However, the US rarely returned the base capital asset, leaving others in a jam.

Upon Strong’s death, no one knew the inner workings of his plan. Nor did they have his deep global political persuasion and ties to carry it on any longer. Without Strong’s skill as a puppeteer, world financial markets and its political players found themselves in a precarious situation. Leading to the greatest ravaging experienced in some time. The Great Depression was an event unlike any other. Leaving no stone unturned as it traveled across the globe. Only to finally end in one great global war (WWII). The ending of 31 years of financial, economic, and military might, shuffled the decks and set the table for a new monetary regime guided by a Bretton Woods system of currency pegs. All money movements now hinged on gold stashed in vaults within US borders, while opposing the views and warnings of Triffin’s Dilemma.

As anger subdued and tensions came down, the fix was in. Realignment was in order so that Bretton Woods could provide all parties access to money once again. The monopoly board was set for another round of play. New leaders, deals, and tiers of countries to shape a new level of understanding as to how the game would be played. The ground rules established how a new currency system would work.

An old story this is, though it sounds all too familiar when relating it to our current state of international and monetary affairs. Once again, finding ourselves at a societal inflection point.

Caught Between the Throws of Money and A Few Men’s Greed.

Reflecting on our past highlights the critical importance of understanding the value of sound money assets. These assets are essential for advancing to a digital monetary system that powers our modern lives—a transition that requires time and a complete shift in thinking.

The Kings and pawns alike are seeking access to new rules and a new monetary base that will provide power and control for the next 100 years. Citizens watch over streams of media as major political players battle behind closed doors. From X (formerly Twitter), to Meta (formerly Facebook), Tiktok and Nostr, pitches are crafted for the open airwaves of the internet. Each side casts memes and propaganda across every news and social media network intending to shape the minds of the next generation of leaders. What’s the goal? Just the same as it was in the early 1900s, the intention is to corner the free market of money and power.

“A man generally has two reasons for doing a thing. One that sounds good, and a real one.”

– JP Morgan

Over the span of the last 20 years our battles have become increasingly cyber in nature. As a result of these conflicts, we’ve seen Bitcoin move like gold of the past. We’ve watched Bitcoin Hashrate migrate from China to the US, where exchanges like Coinbase, Gemini, and Kraken have been constructed to power the future of money, rates, lending and barter across the bits and bytes of our internet pipes.

The Fix for the Next Round of Global World Order Is Almost In.

Big banks, technocrates, Wall Street, and political clout are all jostling for their version of how the future should be told. The difficulty adjustment continues to ratchet as the momentum of our new market places shift.

The transition from guns and army’s to a world of bots and DDOS attacks took time to run its course.

What started with credit cards and advanced technology research projects at the Defense Advanced Research Projects Agency (DARPA) in 1958, led us to the internet, protocols, and partial means of transferring digital money by consensus. With the rise of information and consumer technology, we found ourselves in a digital ecosystem with limited access or control of our money. This new revolution in the digital age gave way to industrial ideals and promoted a shift to a more connected and intelligent world.

As foundations for a new digital financial system have been laid, global relationships were infiltrated as new players emerged. Shifting from ideals of our past monetary fathers, Benjamin Strong (US), Montagu Norman (England), Hjalmar Schacht (Germany), Emile Moreau (France) to new forms of intelligence guided by The Five Eyes (US, UK, Canada, Australia, New Zealand).

When we crossed the chasm of the 21st Century, powers shifted. E-commerce and social platforms steered the attention of business and consumers in such a way that new tools for psychological research were necessary to keep up. From this state of need, the Intelligence Advanced Research Projects Activity (IARPA – 2007) was born to pick up where DARPA left off.

As populations warmed to the ideas of digital scarcity; Bitcoin has risen. Playing the role of the fastest horse for sending sound money over our internet rails. With the momentum of the race shifting, nations are back to warring again. Leading to citizenry shouts of spooks and kooks against anyone attempting to triangulate their location and affiliation.

At this juncture the board is set for players to make their move. A few critical questions should be asked. The answers will dictate the freedoms or draconian measures that follow.

-

What Bitcoiner is playing the role of Ben Strong?

-

What Bitcoin influencers are Norman, Schacht, and Moreau?

-

Has the Digital Bretton Woods conference taken place? If not, then when and what parties will be invited to attend?

These are the private keys that will decide our future. The future of money, power, and control.

New terms and players will dictate the price of properties, utilities, and digital rails that will be traded so we can all transact in a civilized manner. This is a new story with new faces, technologies, and tools. However, it is the same story of money that spans across human history. One that repeats in unison with the 4th Turnings that dictate our times.

* * *

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.

Loading…