By Russell Clark of the Capital Flows and Asset Markets substack

A lot to take in, and think about, but here are are collection of thoughts. It always seemed clear to me that whoever won, the US deficit was not going to shrink. With the US 30 year treasury yield spiking back to 4.6% the market knows this as well.

Why investors have continued to be bullish on TLT remains a mystery to me. Shares outstanding in TLT US should really be falling, not rising, but old habits die hard I guess.

The thing about the President Trump getting reelected and likely sweep by the Republicans is that America First is here to stay. In some ways, this moves US political practice is closer to US business practice. What I mean by that, is that rules are not so important - leverage and power is. If you want to have an independent policy from the US, then you need to have an independent military, and supply chain. Only two or three nations have this, Russia and China and possibly India, and are the only nations that can negotiate with US, mainly as they have an independent military base. The three countries that I have lived in, Australia, Japan and the UK, and now closer to vassal states, than truly independent nations. The UN is also largely redundant. We are back to Great Power political era.

The likely outcome of a Trump win, is the rise of strongmen politicians everywhere, and the remilitarisation of every corner of the globe. The EU needs a European army to remain relevant, but I suspect distrust runs to deep for that to be realistic. Ultimately, the reelection of Trump, signals the end of trade and trust led growth. It ends the era of all getting prosperous together. The market was already foreshadowing this with the dominance of US equities, and this seems likely to continue. The dominant trade of long S&P500 and short Treasuries, also looks likely to continue.

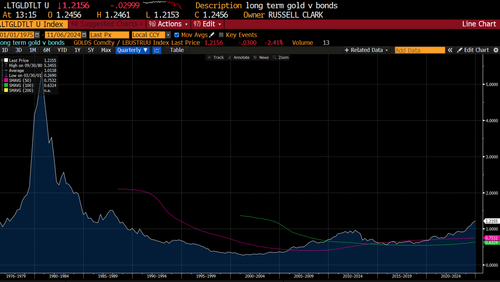

The depressing thing about all of this, is that the countries that bet most heavily of the US remaining a leader of free trade and democracy, are likely to lose the most. Europe that had largely demilitarised after the horrors of two world wars, will be forced to remilitarise, and ponder whether this can be done without conflict. Japan, who has built its economic model around trade with the US, and was the original supporter of buying treasuries instead of gold, is seeing real wages decline, and its economy stagnate. I always found gold in yen terms, are fascinating chart - and its continued sell off points to collapsing relative wealth of the Japanese.

Japan embraced the treasury over gold trade with gusto, accumulation all of its foreign reserves as US treasuries. While forward thinking at the time, it seems to be backward looking now.

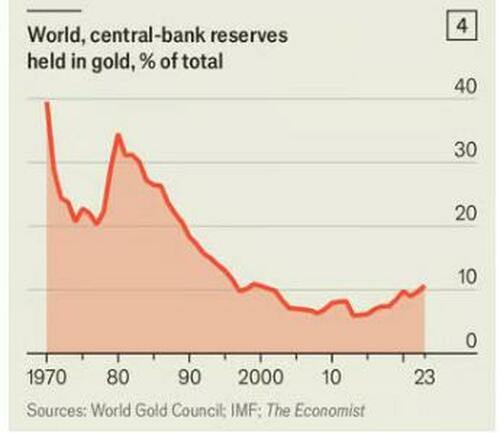

It is striking how the relative performance of gold versus treasuries has matched up with the % of gold in central bank reserves. For gold bugs out there - if we assume we go back to 40% holdings of foreign reserves, and the US tried to maintain nominal value in treasuries, then you get a price of US 10,000 for gold. The alternative is gold stays where it is, and you get 20% interest rates in the US.

Where does it end? Well the US pursued a growth through trade policy, in the hopes that it would export democracy to the rest of the world, while also securing the leading position of the US. It is no coincidence that Trump and the Republican party have changed position when growth through trade looked to be strengthening rivals. The American public has chosen a different path. And US economic dominance in the early 20th century was built upon the destructive wars in Europe and Asia that hobbled rivals, while leaving the US unscathed. America first policies also includes others must fail politics.

The victory of Trump and Republicans also potentially is the next step on moving to a true digital world, that is distinct from the nation state world we live in today. American corporations control almost all the important aspects of the digital world - from optic fibre cables, to social media, to operating systems to payment systems. Large US corporates operate on purely global scale, that is at odds with the domestic focus of nation state. We have already seen that the nation state struggles to enforce its will against large US corporates, and with the reelection of Trump, tax rates will likely fall further. Elon Musk has already made the jump from businessman to politician (with control over SpaceX and Starlink making him the most powerful single person in military matters). The support of Bitcoin, which is outside of the control of the US government, also adds to the idea that we are moving to a new stage in Western civilisation, or returning to an age of Empire, with US tech company the digital world overlords. This would be similar to the arrangement between the UK government and the East India Company back in the day.

In the short term, the obvious trades will work. Long S&P 500, gold, bitcoin and short treasuries. In the longer term, I would bet on politics in the rest of the world turning more violent. Rule of law and free trade politicians are useless against a Trump administration. I see the return of the general-politician globally, and the end of the lawyer-politician. I think that is a shame - but if the most powerful nation wants it that way, then that’s the way its going to be.

By Russell Clark of the Capital Flows and Asset Markets substack

A lot to take in, and think about, but here are are collection of thoughts. It always seemed clear to me that whoever won, the US deficit was not going to shrink. With the US 30 year treasury yield spiking back to 4.6% the market knows this as well.

Why investors have continued to be bullish on TLT remains a mystery to me. Shares outstanding in TLT US should really be falling, not rising, but old habits die hard I guess.

The thing about the President Trump getting reelected and likely sweep by the Republicans is that America First is here to stay. In some ways, this moves US political practice is closer to US business practice. What I mean by that, is that rules are not so important – leverage and power is. If you want to have an independent policy from the US, then you need to have an independent military, and supply chain. Only two or three nations have this, Russia and China and possibly India, and are the only nations that can negotiate with US, mainly as they have an independent military base. The three countries that I have lived in, Australia, Japan and the UK, and now closer to vassal states, than truly independent nations. The UN is also largely redundant. We are back to Great Power political era.

The likely outcome of a Trump win, is the rise of strongmen politicians everywhere, and the remilitarisation of every corner of the globe. The EU needs a European army to remain relevant, but I suspect distrust runs to deep for that to be realistic. Ultimately, the reelection of Trump, signals the end of trade and trust led growth. It ends the era of all getting prosperous together. The market was already foreshadowing this with the dominance of US equities, and this seems likely to continue. The dominant trade of long S&P500 and short Treasuries, also looks likely to continue.

The depressing thing about all of this, is that the countries that bet most heavily of the US remaining a leader of free trade and democracy, are likely to lose the most. Europe that had largely demilitarised after the horrors of two world wars, will be forced to remilitarise, and ponder whether this can be done without conflict. Japan, who has built its economic model around trade with the US, and was the original supporter of buying treasuries instead of gold, is seeing real wages decline, and its economy stagnate. I always found gold in yen terms, are fascinating chart – and its continued sell off points to collapsing relative wealth of the Japanese.

Japan embraced the treasury over gold trade with gusto, accumulation all of its foreign reserves as US treasuries. While forward thinking at the time, it seems to be backward looking now.

It is striking how the relative performance of gold versus treasuries has matched up with the % of gold in central bank reserves. For gold bugs out there – if we assume we go back to 40% holdings of foreign reserves, and the US tried to maintain nominal value in treasuries, then you get a price of US 10,000 for gold. The alternative is gold stays where it is, and you get 20% interest rates in the US.

Where does it end? Well the US pursued a growth through trade policy, in the hopes that it would export democracy to the rest of the world, while also securing the leading position of the US. It is no coincidence that Trump and the Republican party have changed position when growth through trade looked to be strengthening rivals. The American public has chosen a different path. And US economic dominance in the early 20th century was built upon the destructive wars in Europe and Asia that hobbled rivals, while leaving the US unscathed. America first policies also includes others must fail politics.

The victory of Trump and Republicans also potentially is the next step on moving to a true digital world, that is distinct from the nation state world we live in today. American corporations control almost all the important aspects of the digital world – from optic fibre cables, to social media, to operating systems to payment systems. Large US corporates operate on purely global scale, that is at odds with the domestic focus of nation state. We have already seen that the nation state struggles to enforce its will against large US corporates, and with the reelection of Trump, tax rates will likely fall further. Elon Musk has already made the jump from businessman to politician (with control over SpaceX and Starlink making him the most powerful single person in military matters). The support of Bitcoin, which is outside of the control of the US government, also adds to the idea that we are moving to a new stage in Western civilisation, or returning to an age of Empire, with US tech company the digital world overlords. This would be similar to the arrangement between the UK government and the East India Company back in the day.

In the short term, the obvious trades will work. Long S&P 500, gold, bitcoin and short treasuries. In the longer term, I would bet on politics in the rest of the world turning more violent. Rule of law and free trade politicians are useless against a Trump administration. I see the return of the general-politician globally, and the end of the lawyer-politician. I think that is a shame – but if the most powerful nation wants it that way, then that’s the way its going to be.

Loading…