Authored by Sven Henrich via NorthmanTrader.com,

Yesterday markets made new lows for the year accelerating to the downside following up on the 3rd negative start to a year through April in history. Yesterday on my Twitter feed I noted some market facts that lead me today to making the case for an aggressive bear market rally to emerge.

No that’s not the unthinkable, the unthinkable resides in the notion that the tightening cycle is already done in spirit before it has even gotten off the ground and that the Fed’s coming actions are simply playing catch up to what the market has already done.

Per my tweet yesterday:

The tightening cycle, for all intents and purposes, is already over. The market has already done most of it, the Fed will play a bit of catch-up, but the market and the Fed will meet somewhere in the middle & then Fed pivots by pausing.

— Sven Henrich (@NorthmanTrader) May 2, 2022

And yes, that would be bullish risk assets.

So let me present my case.

Firstly, as always: All gather around, come and see, come and see or so the regular spectacle goes where markets take their cue for direction again from a committee, the very committee that has showered markets with free candy liquidity for years only to throw tantrums when that liquidity is taken away only to rejoice when the liquidity is coming back.

Let’s face it: Nothing else has much mattered since 2009. QE comes, markets rally, QE ends, market dump, more QE comes and markets rally only to throw a tantrum again when it all disappears. The last few years have been no different except now we’ve seen it all go to never before seen extremes resulting in the asset bubble of 2021. Voices like myself were urging the Fed to stop the liquidity machine as record fiscal stimulus was flowing through the system making continued record monetary stimulus reckless:

The Fed has zero excuse not to taper. Indeed they should. Let the air out the balloon gently as opposed to risking popping the bubble much harder later with more far reaching consequences.

— Sven Henrich (@NorthmanTrader) July 28, 2021

They've overdone it & now they're boxed in & worried of causing a massive reaction.

But the Fed didn’t listen and neither did retail investors as more retail money flowed into stocks in 2021 then in the previous 17 years combined. By the time the Fed finally got around to tapering and slow walking any notion of tightening it was too late and inflation went out of control and investors got crushed

We got a bear market on our hands and because stock markets have become larger than ever versus the size of the economy the current bear market is already doing its job of causing demand destruction. Data is lagging, but it’s happening all around us which is a good thing because it will result in inflation reversing hard.

So many stocks have been utterly destroyed, not only the speculative stocks in ARKK complex or SPACs, meme stocks or many of the fantasy IPO’s from last year, think Robinhood, COIN, etc, but also stalwarts of the bull market, i..e $NFLX, $FB, even $AMZN getting hammered and stocks like $TSLA seeing drops of over 20% in days.

Case in point by yesterday $NDX had given back the entirety of its gains since the beginning of 2021:

So now we are in a bear market in tech, in small caps and in bonds and now the Fed wants to tighten with this backdrop:

Markets carpet bombing

— Sven Henrich (@NorthmanTrader) April 29, 2022

GDP growth negative

Consumer sentiment in the toilet

Savings rate collapsed

Inflation 8.6%

NOW let's tighten monetary policy, not when GDP growth was 5%+, trillions of fiscal stimulus in the system & inflation already at 5%.

We are the Federal Reserve

People sense the absurdity of what is going on:

They kept printing into a rapidly overheating economy now they're tightening into a rapidly slowing economy

— Sven Henrich (@NorthmanTrader) May 2, 2022

You can't make this up.

I’ll leave it to the reader to decide if this Fed is really this clueless or if this is all part of a larger plan which brings me to the unthinkable and to a key technical call I made back in October of last year when the 10 year was trading at 1.599% for a 3.2% technical target as pointed out in the tweet thread below (worth checking out for the evolution of how well the technical pattern has played):

So inflation is transitory eh?

— Sven Henrich (@NorthmanTrader) October 8, 2021

We'll see.

Best hope then this doesn't play as an inverse or cup and handle or hell follows with it.

Unconfirmed as of yet.$TNX pic.twitter.com/VKbqhDhKUL

Little did I expect the follow through to be as violent and vertical as it has now unfolded but nevertheless here it is:

My original hell premise was predicated on the notion that the debt laden financial construct could not handle this level or rates. It couldn’t in 2018 and it certainly can’t now that $8 trillion in additional debt has been added in those few short years since especially knowing that trillions of debt will have to be refinanced at higher rates in the next year or so. Back then markets dropped 20% when the 10 year hit 3.2% and the Fed funds rate peaked at 2.5%.

So the notion that the Fed wants to see this in the long term is mathematically not rooted in reality. The entire financial system built on cheap money can ill afford a radical shift in the low interest regime. Short term yes, long term, no way no how. Otherwise we’re not talking about a correction and mild recession, but a financial collapse and a depression.

There’s a lot of chatter these days about how the Fed doesn’t care about stocks, how it will force stocks down and that they will do everything to bring inflation down as their primarily goal.

Hello? Does everybody have amnesia The entire bull market since 2009 was founded on one premise and one premise alone: Don’t upset markets. The Fed’s prime directive. Why? Because the Fed has used the stock market to spur demand, it has used the stock market as the primary means through which to manage to economy. Every single correction since 2009 they’ve either flip flopped policy and/or introduced straight out new interventions to stop corrections. Every single time. Even last year the entire song and dance about tapering was specifically designed not to upset markets and avoid a tamper tantrum.

When do we know the Fed to ever get aggressive with tightening in a bear market? We don’t, cause that just doesn’t happen. Having been too dumb slow in their tightening plans the Fed has now put itself in a box of being forced to tighten due to inflation.

But they can’t afford a crash, otherwise we’re not talking recession, we’re talking depression for none of the central banks have actually done anything but talk which means none have the ammunition to actually provide stimulus other than going directly back into QE. Oh wait, other than the Fed they’re still adding liquidity led by the ECB. They need ammunition and they need it quickly, but they can’t cause a crash in the meantime.

The 10 year yield chart above then tells me we are now reaching a very critical point. The original technical target was 3.2%, we’re very close and perhaps it’ll still reach it, but it is ironic that we’ve approached this level now with the Fed on tap tomorrow.

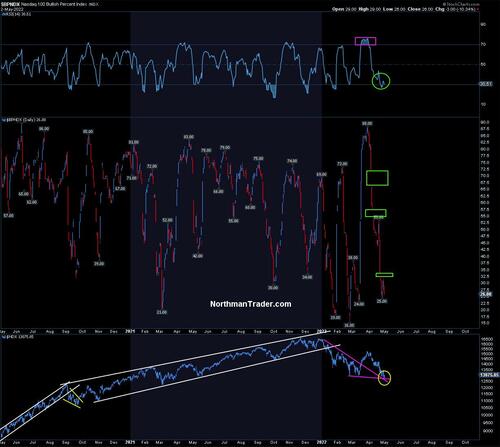

The larger market has reacted to this shift in yields. Namely over-exuberant tech valuations have been destroyed with massive drops in the 60%-90% range in many of the most speculative names. 85% of Nasdaq components below their 200MA and the advance decline collapse has been nothing but stunning:

Note the positive divergence and the potential backtest for $NDX in the chart above.

Fact is we’re approaching this Fed meeting heavily oversold:

What would spark a big rally in my view? A reversal in the trifecta of stress at the moment. The above mentioned yield chart, a reversal in the dollar which has now reached the peak levels it saw during the height of the 2020 Covid crash:

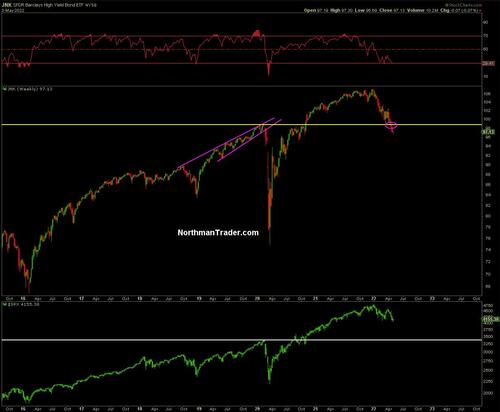

And a reversal in credit, i.e. $JNK which has now dropped below its 2020 peak and is also oversold:

Much of the hype of 2021 and subsequent roll over has brought on comparisons to the year 2000 when the tech bubble burst.

And the current wide range chop in price action in indices is indeed very reminiscent of that time. While we are inclined to think of mainly the Nasdaq crash back then note that indices such as the $DJIA chopped in wide price ranges for the better of a year before the ensuing recession ultimately brought everything down:

Indeed as we know from the 2000 example rallies in context of bubbles bursting can be absolutely vicious:

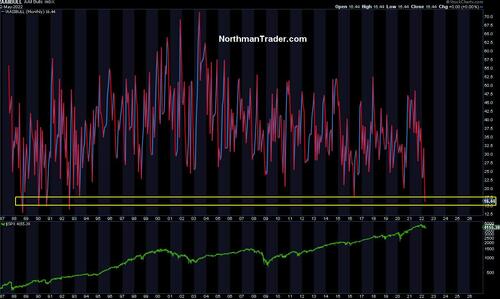

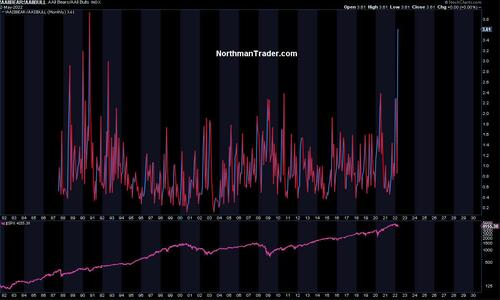

The fuel for such vicious rallies can be found in extreme sentiment readings and the readings we are seeing now are historic:

No bulls:

Lots of bears:

None of this means a structural low is in, I’m talking about a trade-able rally of size which then may end up setting up for another sell.

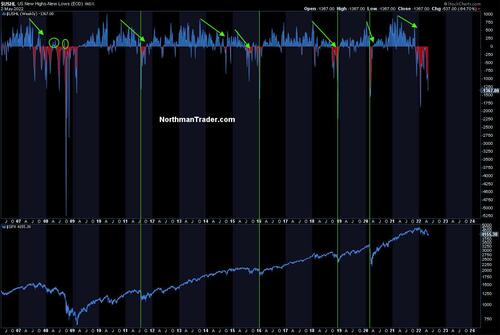

Let’s not forget that this correction has gone on without any move to positive on new high lows for months:

Even during larger corrections (2015/2016) or the financial crisis (2008/2009) we’ve seen counter rallies produce positive readings.

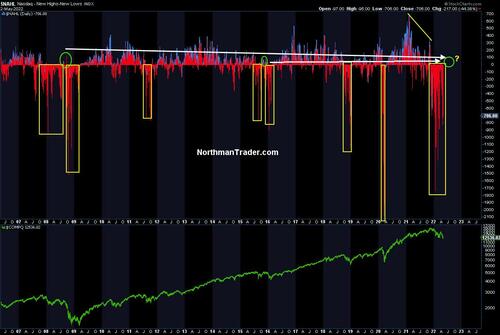

See the Nasdaq:

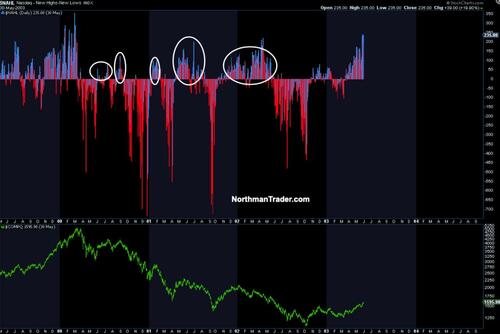

And yes, even more pronounced so during the 2000-2002 tech crash:

We have yet to see any such move to positive readings this year which is highly unusual. So my principle view here is that such a counter rally will emerge at some point.

However the Fed meeting turns out (and it may bring about another scare and even new lows again first) it is then in the past and then we have a big source of liquidity that has been missing in recent weeks return: Buybacks. Google and Apple have announced $70B and $90B in buybacks alone.

Given extreme bearish sentiment, yields, credit and dollar all at points of extreme pivots any such reversals could fuel a massive counter rally.

That’s the premise. Could I be wrong? Absolutely, extremes can become more extremes. Indeed I’m also highly aware of my own bearish outline I posted a while back which started with a similar call for a counter rally:

Incidentally, this was the speculative larger roadmap I proposed to subscribers on March 10 with a view of major MA reconnects to come out of a bullish falling wedge for an initial very aggressive rally.

— Sven Henrich (@NorthmanTrader) March 30, 2022

Then a possible roll over for new lows & lower gaps fill scenario.$DJIA pic.twitter.com/LxMpL7zF01

That chart updated looks to be eerily accurate so far:

But in my view the current confluent set up is worth pursuing to test the long side. But we must recognize the technical set up remains ugly as all the moving averages are pointing south:

For a solid low to be in play we need to see evidence of the market repairing itself, i.e. getting above key MA’s staying above them and see the shorter term MA’s turning north, so a lot of work for bulls ahead.

On the 2 hour chart we see a bullish falling wedge which still has downside risk:

$NDX has a much larger potential bullish wedge and we can note it defended that lower trend line yesterday:

We’ll see.

And the month is very young and as such it still has time to follow the previous monthly 20MA support script:

Corrections are tricky. Over the years we’ve seen many V shaped bottoms, but we’ve also seen more complex corrections such as the 2015/2016 period. This correction here definitely qualifies as a complex one and it is challenging. Ultimately I don’t think we’ve seen the cycle lows and lower ranges into 3400-3800 are all possible, but as 2000 has also taught us these processes can take months and years and in between we can see wild rallies.

Today the Fed meeting begins, tomorrow we will see the outcome and the market reaction.

Concluding: Because the Fed has been so recklessly slow in dealing with inflation the market has lost confidence in the Fed to manage inflation. That’s the tantrum we have here now. So with the Fed raising rates by 50bp tomorrow and signaling there will be more, the psychology may just flip flop from little confidence to more confidence. “We’re on it”. That’s the message the market wants to hear. And as a forward discounting mechanism the market will then start pricing in falling inflation and with it yields may actually come down meeting the Fed somewhere in the middle at which point they will pivot and pause or halt all rate hikes.

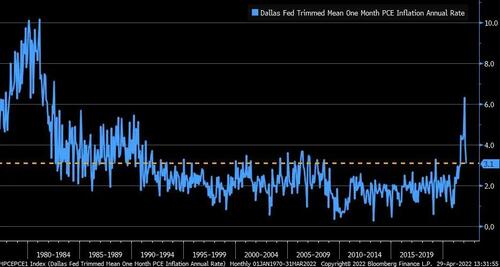

Maybe it’s already happening on the inflation front:

Which seems unthinkable considering the market is now pricing in 10 rate hikes:

Somewhere in between I suspect lies the eventual truth and, if markets agree with this premise, there is room for a sizable rally to emerge first. But as in the year 2000, unless a recession does not emerge, then the next big rally may well set up for another sell for further new lows to come. As always: To be determined, this is all a complex unfolding macro journey.

* * *

For the latest public analysis please visit NorthmanTrader and the NorthCast. To subscribe to our directional market analysis please visit Services.

Authored by Sven Henrich via NorthmanTrader.com,

Yesterday markets made new lows for the year accelerating to the downside following up on the 3rd negative start to a year through April in history. Yesterday on my Twitter feed I noted some market facts that lead me today to making the case for an aggressive bear market rally to emerge.

No that’s not the unthinkable, the unthinkable resides in the notion that the tightening cycle is already done in spirit before it has even gotten off the ground and that the Fed’s coming actions are simply playing catch up to what the market has already done.

Per my tweet yesterday:

The tightening cycle, for all intents and purposes, is already over. The market has already done most of it, the Fed will play a bit of catch-up, but the market and the Fed will meet somewhere in the middle & then Fed pivots by pausing.

And yes, that would be bullish risk assets.— Sven Henrich (@NorthmanTrader) May 2, 2022

So let me present my case.

Firstly, as always: All gather around, come and see, come and see or so the regular spectacle goes where markets take their cue for direction again from a committee, the very committee that has showered markets with free candy liquidity for years only to throw tantrums when that liquidity is taken away only to rejoice when the liquidity is coming back.

Let’s face it: Nothing else has much mattered since 2009. QE comes, markets rally, QE ends, market dump, more QE comes and markets rally only to throw a tantrum again when it all disappears. The last few years have been no different except now we’ve seen it all go to never before seen extremes resulting in the asset bubble of 2021. Voices like myself were urging the Fed to stop the liquidity machine as record fiscal stimulus was flowing through the system making continued record monetary stimulus reckless:

The Fed has zero excuse not to taper. Indeed they should. Let the air out the balloon gently as opposed to risking popping the bubble much harder later with more far reaching consequences.

They’ve overdone it & now they’re boxed in & worried of causing a massive reaction.— Sven Henrich (@NorthmanTrader) July 28, 2021

But the Fed didn’t listen and neither did retail investors as more retail money flowed into stocks in 2021 then in the previous 17 years combined. By the time the Fed finally got around to tapering and slow walking any notion of tightening it was too late and inflation went out of control and investors got crushed

We got a bear market on our hands and because stock markets have become larger than ever versus the size of the economy the current bear market is already doing its job of causing demand destruction. Data is lagging, but it’s happening all around us which is a good thing because it will result in inflation reversing hard.

So many stocks have been utterly destroyed, not only the speculative stocks in ARKK complex or SPACs, meme stocks or many of the fantasy IPO’s from last year, think Robinhood, COIN, etc, but also stalwarts of the bull market, i..e $NFLX, $FB, even $AMZN getting hammered and stocks like $TSLA seeing drops of over 20% in days.

Case in point by yesterday $NDX had given back the entirety of its gains since the beginning of 2021:

So now we are in a bear market in tech, in small caps and in bonds and now the Fed wants to tighten with this backdrop:

Markets carpet bombing

GDP growth negative

Consumer sentiment in the toilet

Savings rate collapsed

Inflation 8.6%NOW let’s tighten monetary policy, not when GDP growth was 5%+, trillions of fiscal stimulus in the system & inflation already at 5%.

We are the Federal Reserve

— Sven Henrich (@NorthmanTrader) April 29, 2022

People sense the absurdity of what is going on:

They kept printing into a rapidly overheating economy now they’re tightening into a rapidly slowing economy

You can’t make this up.

— Sven Henrich (@NorthmanTrader) May 2, 2022

I’ll leave it to the reader to decide if this Fed is really this clueless or if this is all part of a larger plan which brings me to the unthinkable and to a key technical call I made back in October of last year when the 10 year was trading at 1.599% for a 3.2% technical target as pointed out in the tweet thread below (worth checking out for the evolution of how well the technical pattern has played):

So inflation is transitory eh?

We’ll see.

Best hope then this doesn’t play as an inverse or cup and handle or hell follows with it.

Unconfirmed as of yet.$TNX pic.twitter.com/VKbqhDhKUL

— Sven Henrich (@NorthmanTrader) October 8, 2021

Little did I expect the follow through to be as violent and vertical as it has now unfolded but nevertheless here it is:

My original hell premise was predicated on the notion that the debt laden financial construct could not handle this level or rates. It couldn’t in 2018 and it certainly can’t now that $8 trillion in additional debt has been added in those few short years since especially knowing that trillions of debt will have to be refinanced at higher rates in the next year or so. Back then markets dropped 20% when the 10 year hit 3.2% and the Fed funds rate peaked at 2.5%.

So the notion that the Fed wants to see this in the long term is mathematically not rooted in reality. The entire financial system built on cheap money can ill afford a radical shift in the low interest regime. Short term yes, long term, no way no how. Otherwise we’re not talking about a correction and mild recession, but a financial collapse and a depression.

There’s a lot of chatter these days about how the Fed doesn’t care about stocks, how it will force stocks down and that they will do everything to bring inflation down as their primarily goal.

Hello? Does everybody have amnesia? The entire bull market since 2009 was founded on one premise and one premise alone: Don’t upset markets. The Fed’s prime directive. Why? Because the Fed has used the stock market to spur demand, it has used the stock market as the primary means through which to manage to economy. Every single correction since 2009 they’ve either flip flopped policy and/or introduced straight out new interventions to stop corrections. Every single time. Even last year the entire song and dance about tapering was specifically designed not to upset markets and avoid a tamper tantrum.

When do we know the Fed to ever get aggressive with tightening in a bear market? We don’t, cause that just doesn’t happen. Having been too dumb slow in their tightening plans the Fed has now put itself in a box of being forced to tighten due to inflation.

But they can’t afford a crash, otherwise we’re not talking recession, we’re talking depression for none of the central banks have actually done anything but talk which means none have the ammunition to actually provide stimulus other than going directly back into QE. Oh wait, other than the Fed they’re still adding liquidity led by the ECB. They need ammunition and they need it quickly, but they can’t cause a crash in the meantime.

The 10 year yield chart above then tells me we are now reaching a very critical point. The original technical target was 3.2%, we’re very close and perhaps it’ll still reach it, but it is ironic that we’ve approached this level now with the Fed on tap tomorrow.

The larger market has reacted to this shift in yields. Namely over-exuberant tech valuations have been destroyed with massive drops in the 60%-90% range in many of the most speculative names. 85% of Nasdaq components below their 200MA and the advance decline collapse has been nothing but stunning:

Note the positive divergence and the potential backtest for $NDX in the chart above.

Fact is we’re approaching this Fed meeting heavily oversold:

What would spark a big rally in my view? A reversal in the trifecta of stress at the moment. The above mentioned yield chart, a reversal in the dollar which has now reached the peak levels it saw during the height of the 2020 Covid crash:

And a reversal in credit, i.e. $JNK which has now dropped below its 2020 peak and is also oversold:

Much of the hype of 2021 and subsequent roll over has brought on comparisons to the year 2000 when the tech bubble burst.

And the current wide range chop in price action in indices is indeed very reminiscent of that time. While we are inclined to think of mainly the Nasdaq crash back then note that indices such as the $DJIA chopped in wide price ranges for the better of a year before the ensuing recession ultimately brought everything down:

Indeed as we know from the 2000 example rallies in context of bubbles bursting can be absolutely vicious:

The fuel for such vicious rallies can be found in extreme sentiment readings and the readings we are seeing now are historic:

No bulls:

Lots of bears:

None of this means a structural low is in, I’m talking about a trade-able rally of size which then may end up setting up for another sell.

Let’s not forget that this correction has gone on without any move to positive on new high lows for months:

Even during larger corrections (2015/2016) or the financial crisis (2008/2009) we’ve seen counter rallies produce positive readings.

See the Nasdaq:

And yes, even more pronounced so during the 2000-2002 tech crash:

We have yet to see any such move to positive readings this year which is highly unusual. So my principle view here is that such a counter rally will emerge at some point.

However the Fed meeting turns out (and it may bring about another scare and even new lows again first) it is then in the past and then we have a big source of liquidity that has been missing in recent weeks return: Buybacks. Google and Apple have announced $70B and $90B in buybacks alone.

Given extreme bearish sentiment, yields, credit and dollar all at points of extreme pivots any such reversals could fuel a massive counter rally.

That’s the premise. Could I be wrong? Absolutely, extremes can become more extremes. Indeed I’m also highly aware of my own bearish outline I posted a while back which started with a similar call for a counter rally:

Incidentally, this was the speculative larger roadmap I proposed to subscribers on March 10 with a view of major MA reconnects to come out of a bullish falling wedge for an initial very aggressive rally.

Then a possible roll over for new lows & lower gaps fill scenario.$DJIA pic.twitter.com/LxMpL7zF01— Sven Henrich (@NorthmanTrader) March 30, 2022

That chart updated looks to be eerily accurate so far:

But in my view the current confluent set up is worth pursuing to test the long side. But we must recognize the technical set up remains ugly as all the moving averages are pointing south:

For a solid low to be in play we need to see evidence of the market repairing itself, i.e. getting above key MA’s staying above them and see the shorter term MA’s turning north, so a lot of work for bulls ahead.

On the 2 hour chart we see a bullish falling wedge which still has downside risk:

$NDX has a much larger potential bullish wedge and we can note it defended that lower trend line yesterday:

We’ll see.

And the month is very young and as such it still has time to follow the previous monthly 20MA support script:

Corrections are tricky. Over the years we’ve seen many V shaped bottoms, but we’ve also seen more complex corrections such as the 2015/2016 period. This correction here definitely qualifies as a complex one and it is challenging. Ultimately I don’t think we’ve seen the cycle lows and lower ranges into 3400-3800 are all possible, but as 2000 has also taught us these processes can take months and years and in between we can see wild rallies.

Today the Fed meeting begins, tomorrow we will see the outcome and the market reaction.

Concluding: Because the Fed has been so recklessly slow in dealing with inflation the market has lost confidence in the Fed to manage inflation. That’s the tantrum we have here now. So with the Fed raising rates by 50bp tomorrow and signaling there will be more, the psychology may just flip flop from little confidence to more confidence. “We’re on it”. That’s the message the market wants to hear. And as a forward discounting mechanism the market will then start pricing in falling inflation and with it yields may actually come down meeting the Fed somewhere in the middle at which point they will pivot and pause or halt all rate hikes.

Maybe it’s already happening on the inflation front:

Which seems unthinkable considering the market is now pricing in 10 rate hikes:

Somewhere in between I suspect lies the eventual truth and, if markets agree with this premise, there is room for a sizable rally to emerge first. But as in the year 2000, unless a recession does not emerge, then the next big rally may well set up for another sell for further new lows to come. As always: To be determined, this is all a complex unfolding macro journey.

* * *

For the latest public analysis please visit NorthmanTrader and the NorthCast. To subscribe to our directional market analysis please visit Services.