By Peter Tchir of Academy Securities

This Year’s Emmy for Outstanding Reality Series Goes to…

The Debt Ceiling.

Voters were just amazed at how much was made from such a flimsy topic. Others commented that the debt ceiling had become tired, worn, and too predictable, but this year’s cast of characters brought out some new energy. While highly unusual to be given an award for a series that hasn’t been finished, it just stood out as being deserving of the recognition. Critics claimed that it was manufactured, unbelievable, and with one-dimensional characters constrained by an unbelievable script, but the audience is always right!

How can this move markets when 95% of people believe that a default cannot happen? Even those who think that it could happen don’t believe that it is likely. Yet, markets moved on a series of headlines, including the ever popular “the meeting ended abruptly in disagreement” followed by “they are heading back to the table”.

Who out there wasn’t gripped by the tale? The “behind the scenes” end of season reveal should be exciting. Just imagine senior political officials huddled in an office, apparently discussing the fate of the nation’s debt, but in reality are all logged into their trading accounts to make sure that they buy or sell ahead of the news. Ok, I’m sure that the last part didn’t happen, but it is kind of funny (in a sad way) to think about, as insider trading isn’t prohibited in any way on the hill and the headlines, especially late in the week, seemed to be perfect for triggering buy programs and later a sell program or two.

In any case, the debt ceiling continues to take up a lot of focus for markets. Probably far too much focus as default seems unlikely, and despite the “world is ending” arguments, I don’t see a default (that is cured within a few days or a week) as being devastating. Longer-term maybe, but I’d likely buy any “default dip”.

In the meantime, the S&P (up 1.7%) and Nasdaq (up 3.0%) posted strong weeks even as rates rose rather significantly. I didn’t believe that we would see much of a “debt ceiling resolved” bounce since I don’t think that many have been shorting against the debt ceiling specifically.

Next Week

Last week, Academy was a lead manager on Bank of NY’s 3NC2 bonds. Always exciting for Academy when we get selected for such a senior role. I spent much of the week away from the screens, as we travelled from Peoria to Kiawah and then on to DC and Virginia. I got to spend time with several of our generals and admirals and look forward to doing a more geopolitical slanted macro piece early next week. China was front and center, as was the dollar, but more on that on Tuesday.

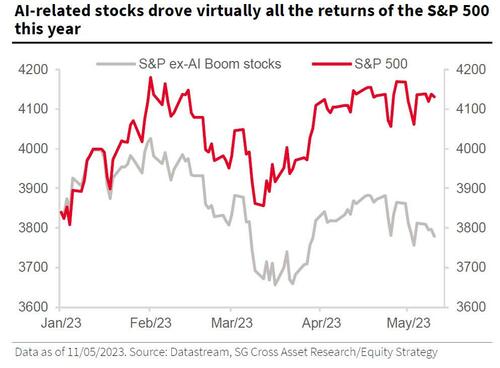

On Tuesday we get NVDA earnings. The stock is up over 110% year-to-date and is a focal point for the AI theme. When looking at markets for the past month (S&P up 1.4% and Nasdaq up 4.9%), I’m pretty sure that if you pull the “AI themed stocks” out of the S&P 500 it would have been negative.

AI is the growth story and undoubtedly is changing the world. Everyone is examining AI and thinking about not just how to use it, but how to keep their jobs relevant in an AI driven world. I’m fully on board with that, but have valuations gotten ahead of themselves? Is AI really big enough (and soon enough) to prop up the entire market? However, I can see the rationale and could be convinced that there is a lot more to come. On the other hand, I’m old enough to remember the “metaverse” (and that rally) and a time when companies that were changing their names to include “blockchain” saw significant pops. Everything about the AI story seems much bigger than either of those examples, but the market seems to have a habit of getting ahead of itself. In a market where there has been so little to like (I keep seeing stats complaining about the lack of breadth), it is easy to gravitate to the one story that has legs. The NVDA earnings (and call) could be the biggest market driver of any release this earnings season, which is an accomplishment in its own right!

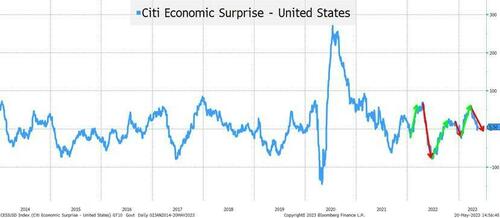

In between flights, checking in and out of hotel rooms, discussing geopolitics, digesting debt ceiling headlines, and getting smarter about the AI revolution, I did think a bit about the economy. We saw some “mixed” data last week, but nothing that changes my view that the best is behind us. Rather than haphazardly pulling together some charts, I will go back to an old favorite – the Citi Economic Surprise Index.

A few weeks ago we postulated that we would see a downturn in the “surprise” index. The “surprise” index is interesting because it is “relative”. Just because it is declining doesn’t mean that the data is bad. It could just be that expectations got so strong that even “good” data created a negative surprise. This time around, the data has gotten weaker, since I’m finding very few positive economists (which, as a contrarian, scares me as I’m definitely part of the consensus).

As the data deteriorates, forecasts will be lowered. I do think that once we make it through the debt ceiling (which really seems like just a bad idea for a reality TV series) and the AI earnings, we will see some economic bears get some airtime. As data disappoints, those that were looking for a downturn in the data (and expecting a recession) will get some more attention, which should act as a headwind for risk.

By the middle of next week, we will be back to focusing on the economy and what that means for markets (and that won’t be supportive).

In the meantime, I just want to thank all of Academy’s customers, not just for the business and opportunities that you provide us with, but for all of the discussions and information sharing which makes us smarter and better able to serve you!

Thanks again! And if I sound too harsh on DC and the time spent on the debt ceiling, I actually toned down my comments and I am pretty sure that my editors will do the same!

By Peter Tchir of Academy Securities

This Year’s Emmy for Outstanding Reality Series Goes to…

The Debt Ceiling.

Voters were just amazed at how much was made from such a flimsy topic. Others commented that the debt ceiling had become tired, worn, and too predictable, but this year’s cast of characters brought out some new energy. While highly unusual to be given an award for a series that hasn’t been finished, it just stood out as being deserving of the recognition. Critics claimed that it was manufactured, unbelievable, and with one-dimensional characters constrained by an unbelievable script, but the audience is always right!

How can this move markets when 95% of people believe that a default cannot happen? Even those who think that it could happen don’t believe that it is likely. Yet, markets moved on a series of headlines, including the ever popular “the meeting ended abruptly in disagreement” followed by “they are heading back to the table”.

Who out there wasn’t gripped by the tale? The “behind the scenes” end of season reveal should be exciting. Just imagine senior political officials huddled in an office, apparently discussing the fate of the nation’s debt, but in reality are all logged into their trading accounts to make sure that they buy or sell ahead of the news. Ok, I’m sure that the last part didn’t happen, but it is kind of funny (in a sad way) to think about, as insider trading isn’t prohibited in any way on the hill and the headlines, especially late in the week, seemed to be perfect for triggering buy programs and later a sell program or two.

In any case, the debt ceiling continues to take up a lot of focus for markets. Probably far too much focus as default seems unlikely, and despite the “world is ending” arguments, I don’t see a default (that is cured within a few days or a week) as being devastating. Longer-term maybe, but I’d likely buy any “default dip”.

In the meantime, the S&P (up 1.7%) and Nasdaq (up 3.0%) posted strong weeks even as rates rose rather significantly. I didn’t believe that we would see much of a “debt ceiling resolved” bounce since I don’t think that many have been shorting against the debt ceiling specifically.

Next Week

Last week, Academy was a lead manager on Bank of NY’s 3NC2 bonds. Always exciting for Academy when we get selected for such a senior role. I spent much of the week away from the screens, as we travelled from Peoria to Kiawah and then on to DC and Virginia. I got to spend time with several of our generals and admirals and look forward to doing a more geopolitical slanted macro piece early next week. China was front and center, as was the dollar, but more on that on Tuesday.

On Tuesday we get NVDA earnings. The stock is up over 110% year-to-date and is a focal point for the AI theme. When looking at markets for the past month (S&P up 1.4% and Nasdaq up 4.9%), I’m pretty sure that if you pull the “AI themed stocks” out of the S&P 500 it would have been negative.

AI is the growth story and undoubtedly is changing the world. Everyone is examining AI and thinking about not just how to use it, but how to keep their jobs relevant in an AI driven world. I’m fully on board with that, but have valuations gotten ahead of themselves? Is AI really big enough (and soon enough) to prop up the entire market? However, I can see the rationale and could be convinced that there is a lot more to come. On the other hand, I’m old enough to remember the “metaverse” (and that rally) and a time when companies that were changing their names to include “blockchain” saw significant pops. Everything about the AI story seems much bigger than either of those examples, but the market seems to have a habit of getting ahead of itself. In a market where there has been so little to like (I keep seeing stats complaining about the lack of breadth), it is easy to gravitate to the one story that has legs. The NVDA earnings (and call) could be the biggest market driver of any release this earnings season, which is an accomplishment in its own right!

In between flights, checking in and out of hotel rooms, discussing geopolitics, digesting debt ceiling headlines, and getting smarter about the AI revolution, I did think a bit about the economy. We saw some “mixed” data last week, but nothing that changes my view that the best is behind us. Rather than haphazardly pulling together some charts, I will go back to an old favorite – the Citi Economic Surprise Index.

A few weeks ago we postulated that we would see a downturn in the “surprise” index. The “surprise” index is interesting because it is “relative”. Just because it is declining doesn’t mean that the data is bad. It could just be that expectations got so strong that even “good” data created a negative surprise. This time around, the data has gotten weaker, since I’m finding very few positive economists (which, as a contrarian, scares me as I’m definitely part of the consensus).

As the data deteriorates, forecasts will be lowered. I do think that once we make it through the debt ceiling (which really seems like just a bad idea for a reality TV series) and the AI earnings, we will see some economic bears get some airtime. As data disappoints, those that were looking for a downturn in the data (and expecting a recession) will get some more attention, which should act as a headwind for risk.

By the middle of next week, we will be back to focusing on the economy and what that means for markets (and that won’t be supportive).

In the meantime, I just want to thank all of Academy’s customers, not just for the business and opportunities that you provide us with, but for all of the discussions and information sharing which makes us smarter and better able to serve you!

Thanks again! And if I sound too harsh on DC and the time spent on the debt ceiling, I actually toned down my comments and I am pretty sure that my editors will do the same!

Loading…