Earlier this week we pointed out the striking plunge in the Treasury's cash balance which had averaged around $800 billion for the past 18 months, and which plunged by $480 billion in the past month.

Treasury cash down $480 billion in the past month. pic.twitter.com/uV4GDNGheO

— zerohedge (@zerohedge) March 25, 2025

Regular readers are aware of the reason for this plunge: ever since the US hit the debt ceiling in the last days of the Biden administration, the US Treasury has been unable to issue new debt and so has been forced to draw down its cash to fund day to day operations.

Obviously, there is a limit to how much longer this can continue: after all, once the cash balance hits 0, the Treasury will have to start prioritizing payments, and eventually, it may even have to delay payments of interest or repayments of principal... better known as default.

Which brings us to the latest report from the Congressional Budget Office published this morning which warned that the federal government could run out of enough money to pay all of its bills on time as soon as August if lawmakers fail to raise or suspend the debt limit, to wit:

The Congressional Budget Office estimates that if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections. (source)

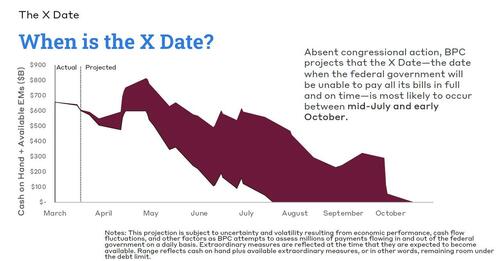

On Monday, the Bipartisan Policy Center said that according to public data the Treasury will be forced to start defaulting on obligations sometime between mid-July and early October.

The CBO also cautioned that if the government’s borrowing needs are "significantly greater than CBO projects, the Treasury’s resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30."

The date is uncertain because of the unpredictable nature of tax receipts, and Rep. Jason Smith of Missouri, chair of the House Ways and Means Committee, said earlier this month that it could come as early as mid-May.

Henrietta Treyz, director of economic policy at Veda Partners, wrote in a Monday note to clients that an earlier "x date" would be beneficial to House Republicans and those rooting for the Trump tax plan to be initiated in a single piece of legislation as soon as possible.

The Treasury Department has been using special accounting maneuvers since Jan. 21 to avoid breaching the $36.1 trillion debt ceiling, which kicked in at the start of the year. But the department has yet to offer specific guidance on when those measures will be exhausted.

"If Republicans cannot pass their tax bill before the debt ceiling must be raised, then it will need to be handled separately, which would require Democratic support," according to Brian Gardner, policy analyst at Stifel, said in a Monday note to clients.

President Trump and Republicans are attempting to pass a more than $4 trillion extension of the 2017 individual tax cuts, the benefits of which went mainly to wealthy Americans, according to a range of analyses. The president also wants to include more politically palatable changes - like ending taxes on tips, overtime and Social Security benefits - which could balloon the cost to more than $11 trillion over 10 years, according to the Committee for a Responsible Federal Budget.

To enact these cuts, the GOP is relying on a process called budget reconciliation, which enables the bill to pass the Senate with just 50 votes, according to that chamber's internal rules. They could use that bill to also raise the debt ceiling simultaneously, but many congressional Republicans want to avoid cosigning trillions of dollars in new debt without the political cover of bipartisan support.

House Republicans want to move quickly to pass a tax cut - paid for in part by potentially unpopular cuts to Medicaid - put a win on the board for President Trump and hope that any political blowback subsides before the midterm elections in November 2026.

"Senate Republicans are not particularly interested in hiking the debt ceiling via reconciliation," Treyz wrote, adding that Republicans in the upper chamber "are more than comfortable taking all year to write their tax bill."

The Senate GOP caucus doesn't feature the same proportion of ideologically driven members who are as concerned about cutting spending as they are cutting taxes, Treyz noted. Senate Republicans are meeting this week to determine whether they can forge ahead with a tax plan that features much smaller cuts to Medicaid and other programs.

"If Republicans cannot pass their tax bill before the debt ceiling must be raised, then it will need to be handled separately, which would require Democratic support," warned Stifel's Gardner.

Under that scenario, Democratic Senate Minority Leader Chuck Schumer will be under intense pressure to enact concessions, after facing blowback from the Democratic base following Senate Democrats' decision to allow a government-funding bill to pass earlier this month, Gardner said.

That could set up a scenario where intense brinksmanship is seen as politically necessary for both sides, and reignite a debate over whether the Treasury can prioritize interest payments to Treasury bondholders while holding back payments for other federal obligations. "If such a scenario plays out ... that will increase market volatility," according to Gardner.

Battle lines are already being drawn on the issue, with House Democratic Caucus Chair Pete Aguilar telling reporters Tuesday that when it comes to the debt ceiling, "nothing should be given away for free."

Earlier this week we pointed out the striking plunge in the Treasury’s cash balance which had averaged around $800 billion for the past 18 months, and which plunged by $480 billion in the past month.

Treasury cash down $480 billion in the past month. pic.twitter.com/uV4GDNGheO

— zerohedge (@zerohedge) March 25, 2025

Regular readers are aware of the reason for this plunge: ever since the US hit the debt ceiling in the last days of the Biden administration, the US Treasury has been unable to issue new debt and so has been forced to draw down its cash to fund day to day operations.

Obviously, there is a limit to how much longer this can continue: after all, once the cash balance hits 0, the Treasury will have to start prioritizing payments, and eventually, it may even have to delay payments of interest or repayments of principal… better known as default.

Which brings us to the latest report from the Congressional Budget Office published this morning which warned that the federal government could run out of enough money to pay all of its bills on time as soon as August if lawmakers fail to raise or suspend the debt limit, to wit:

The Congressional Budget Office estimates that if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections. (source)

On Monday, the Bipartisan Policy Center said that according to public data the Treasury will be forced to start defaulting on obligations sometime between mid-July and early October.

The CBO also cautioned that if the government’s borrowing needs are “significantly greater than CBO projects, the Treasury’s resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30.”

The date is uncertain because of the unpredictable nature of tax receipts, and Rep. Jason Smith of Missouri, chair of the House Ways and Means Committee, said earlier this month that it could come as early as mid-May.

Henrietta Treyz, director of economic policy at Veda Partners, wrote in a Monday note to clients that an earlier “x date” would be beneficial to House Republicans and those rooting for the Trump tax plan to be initiated in a single piece of legislation as soon as possible.

The Treasury Department has been using special accounting maneuvers since Jan. 21 to avoid breaching the $36.1 trillion debt ceiling, which kicked in at the start of the year. But the department has yet to offer specific guidance on when those measures will be exhausted.

“If Republicans cannot pass their tax bill before the debt ceiling must be raised, then it will need to be handled separately, which would require Democratic support,” according to Brian Gardner, policy analyst at Stifel, said in a Monday note to clients.

President Trump and Republicans are attempting to pass a more than $4 trillion extension of the 2017 individual tax cuts, the benefits of which went mainly to wealthy Americans, according to a range of analyses. The president also wants to include more politically palatable changes – like ending taxes on tips, overtime and Social Security benefits – which could balloon the cost to more than $11 trillion over 10 years, according to the Committee for a Responsible Federal Budget.

To enact these cuts, the GOP is relying on a process called budget reconciliation, which enables the bill to pass the Senate with just 50 votes, according to that chamber’s internal rules. They could use that bill to also raise the debt ceiling simultaneously, but many congressional Republicans want to avoid cosigning trillions of dollars in new debt without the political cover of bipartisan support.

House Republicans want to move quickly to pass a tax cut – paid for in part by potentially unpopular cuts to Medicaid – put a win on the board for President Trump and hope that any political blowback subsides before the midterm elections in November 2026.

“Senate Republicans are not particularly interested in hiking the debt ceiling via reconciliation,” Treyz wrote, adding that Republicans in the upper chamber “are more than comfortable taking all year to write their tax bill.”

The Senate GOP caucus doesn’t feature the same proportion of ideologically driven members who are as concerned about cutting spending as they are cutting taxes, Treyz noted. Senate Republicans are meeting this week to determine whether they can forge ahead with a tax plan that features much smaller cuts to Medicaid and other programs.

“If Republicans cannot pass their tax bill before the debt ceiling must be raised, then it will need to be handled separately, which would require Democratic support,” warned Stifel’s Gardner.

Under that scenario, Democratic Senate Minority Leader Chuck Schumer will be under intense pressure to enact concessions, after facing blowback from the Democratic base following Senate Democrats’ decision to allow a government-funding bill to pass earlier this month, Gardner said.

That could set up a scenario where intense brinksmanship is seen as politically necessary for both sides, and reignite a debate over whether the Treasury can prioritize interest payments to Treasury bondholders while holding back payments for other federal obligations. “If such a scenario plays out … that will increase market volatility,” according to Gardner.

Battle lines are already being drawn on the issue, with House Democratic Caucus Chair Pete Aguilar telling reporters Tuesday that when it comes to the debt ceiling, “nothing should be given away for free.”

Loading…