By Russell Clark of The Capital Flows and Asset Markets Substack

I get asked a lot about whether I am going to go back to the asset management industry. The temptation is strong. Lets say I find a great trade, then perhaps I can increase my net worth 3 or 4 times over a 10 year run. But if its a trade that can also raise capital, and become a cornerstone of a fund management business, then you are a looking at something that increase your wealth exponentially. The best trades are always contrarian in some way, and so you really need to be convinced to make them work.

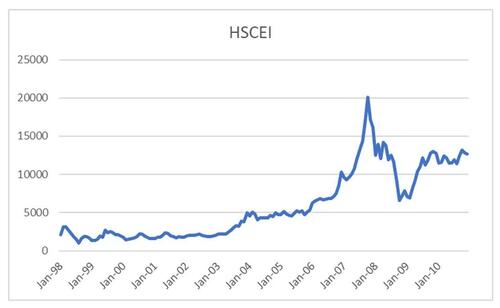

I have had two mega trades that really moved the needle for me. The first was China. In 1998, I was living in Hong Kong, and one job I had was to take Japanese executives up to visit factories in China. I learnt two things from this - first China had amazing infrastructure. I still remember arriving at a huge airport in Guilin and only seeing two flights scheduled to land that day. I asked my brother why build such a big airport, and he said the CCP plans for the future. From 1998 to 2008, I made it a priority to try and latch my career to that of China as close as possible. This was more difficult than you could imagine. In 2002, after two years working in Australia, I tried to get a transfer to Hong Kong. There were no jobs. The closest jobs to “China” I could come up with was an auto analyst in Japan, or an emerging market analyst in London. I went with the latter, but the pay was so low, the custom official asked me how I was going to survive in London. He only let me in when I assured him my company was paying for accommodation. And from 2002, I ran the bull market first as an analyst, and then from 2006 as fund manager all the way up.

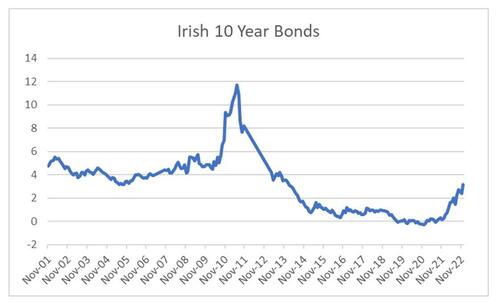

I managed to get short emerging markets and China in 2008, but was still short in 2009, when China launched its huge stimulus program. I was certain that a economic growth programme centred on not only building more housing, but getting house prices to rise was doomed to failure. At the time, Chinese induced stimulus and inflation, as well as the ongoing Eurocrisis had led people to be very bearish on bonds. But I was pretty certain that a country like Ireland would never be allowed to default, and that inflation was going to be much weaker than expected. In 2011, buying bonds was a 10 year mega trade.

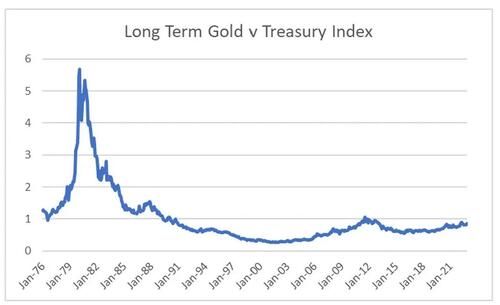

When Russia invaded Ukraine, this has made me think that the new mega trade, was short bonds long gold. This was part of a longer term idea that we are moving from pro-capital policies to pro-labor policies. This has led me to keep thinking that we might see a repeat of the 1970s in terms of gold versus bonds.

However, as I have been reading about the war, a new thought, and potential variant mega trade has started to form in my mind.

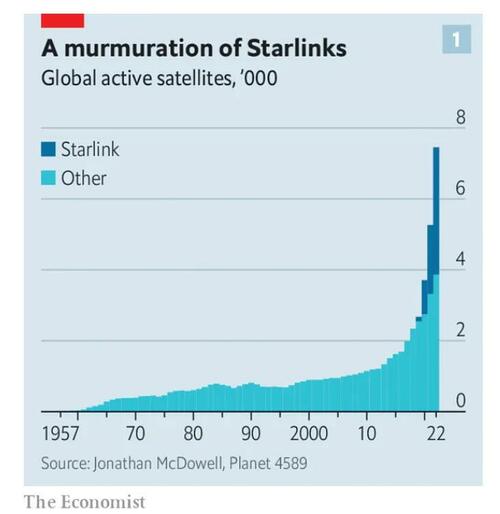

If you had previously asked me about Elon Musk’s SpaceX programme, Jeff Bezos’ Blue Origin, or Branson’s Virgin Galactic, I would have assured you it was a good sign of the top of the tech market, just as Japanese plans to grow mushrooms on the moon was a top in 1980s. Space and the satellite business have tended to be blackholes (pun intended) for both private and public sector. Elon Musk with his development of reusable rockets, and has greatly reduced the cost of launching satellites. On the back of this he launched his Starlink business. The transformation of satellite business have been stunning.

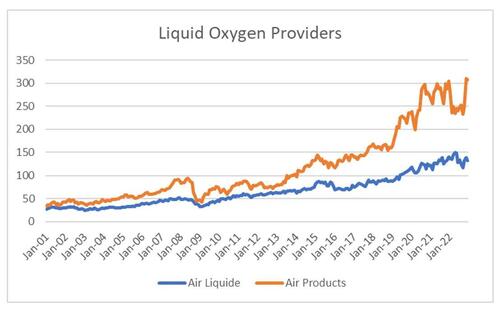

As the Economist article this week makes clear, Ukrainian access to Starlink has probably been one of the key factors in Ukrainian success in turning the tide of the war. Even more important, is that Starlink has continued to work despite Russian best efforts to disrupt it. This is the most important feature of the war. Musk is now in control a telecommunication network that cannot be disrupted by governments, and a telecommunication network that is better than the current satellite based networks that every other country uses. As far as I can tell, the satellites and the software used with Starlink can be easily copied. The real key is the ability to launch many satellites quickly and cheaply. That is SpaceX is really the valuable asset, not Starlink. The military implication is that every country that wishes to have an independent military, needs to develop its own SpaceX program. China and India definitely, Russia probably, Europe and Japan maybe. I think it will be reasonable to expect in 10 years time, that there will 3 or 4 SpaceXs operating, and that global launches to space could be almost a daily event. I am pretty sure, this will not be a profitable venture, but as it is necessary for military advantage, it will happen anyway. One area that should see surging demand is rocket fuel - and particularly liquid oxygen. Space travel is a new area of research for me, but the internet suggest Air Liquide and Air Products (the clue is in the name) are key supplies of liquid oxygen, and both stocks have been reassuringly good performers.

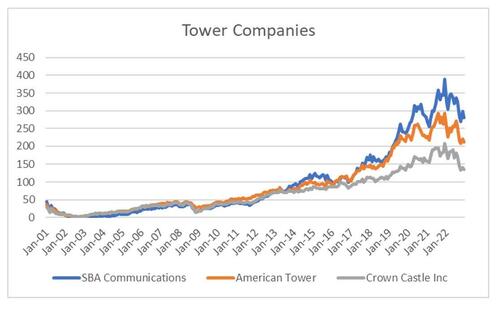

Thinking more long term, the emergence of competitive satellite business with limited latency and/or ability to be disrupted will have significance consequences for land based telecommunication businesses. The current mobile phone base tower businesses have been built around monopolising the best area for base towers, and the getting mobile phone companies to agree CPI + price agreements over many years. And like any good short idea, they have been reassuringly weak.

When Russia originally invaded Ukraine, I worried that this would lead China to either join Russia, or catalyse a Chinese invasion of Taiwan. The military success of Starlink, makes this seem less likely to me. So this is bullish in some respects. But Starlink is going to cause a new arms/space race, and within that I can see a good trade in long space fuel, and short tower companies. Space fuel is commodity linked, and tower companies were seen as bond proxies for years, so after all that, I end up back with a surrogate long GLD/short TLT trade. That’s still fine by me - hopefully for you too. Space is a mega trade, that seems to fit into the political environment of a shift to pro-labour. Maybe I should set up a fund - but in the mean time, I will keep publishing my ideas here.

By Russell Clark of The Capital Flows and Asset Markets Substack

I get asked a lot about whether I am going to go back to the asset management industry. The temptation is strong. Lets say I find a great trade, then perhaps I can increase my net worth 3 or 4 times over a 10 year run. But if its a trade that can also raise capital, and become a cornerstone of a fund management business, then you are a looking at something that increase your wealth exponentially. The best trades are always contrarian in some way, and so you really need to be convinced to make them work.

I have had two mega trades that really moved the needle for me. The first was China. In 1998, I was living in Hong Kong, and one job I had was to take Japanese executives up to visit factories in China. I learnt two things from this – first China had amazing infrastructure. I still remember arriving at a huge airport in Guilin and only seeing two flights scheduled to land that day. I asked my brother why build such a big airport, and he said the CCP plans for the future. From 1998 to 2008, I made it a priority to try and latch my career to that of China as close as possible. This was more difficult than you could imagine. In 2002, after two years working in Australia, I tried to get a transfer to Hong Kong. There were no jobs. The closest jobs to “China” I could come up with was an auto analyst in Japan, or an emerging market analyst in London. I went with the latter, but the pay was so low, the custom official asked me how I was going to survive in London. He only let me in when I assured him my company was paying for accommodation. And from 2002, I ran the bull market first as an analyst, and then from 2006 as fund manager all the way up.

I managed to get short emerging markets and China in 2008, but was still short in 2009, when China launched its huge stimulus program. I was certain that a economic growth programme centred on not only building more housing, but getting house prices to rise was doomed to failure. At the time, Chinese induced stimulus and inflation, as well as the ongoing Eurocrisis had led people to be very bearish on bonds. But I was pretty certain that a country like Ireland would never be allowed to default, and that inflation was going to be much weaker than expected. In 2011, buying bonds was a 10 year mega trade.

When Russia invaded Ukraine, this has made me think that the new mega trade, was short bonds long gold. This was part of a longer term idea that we are moving from pro-capital policies to pro-labor policies. This has led me to keep thinking that we might see a repeat of the 1970s in terms of gold versus bonds.

However, as I have been reading about the war, a new thought, and potential variant mega trade has started to form in my mind.

If you had previously asked me about Elon Musk’s SpaceX programme, Jeff Bezos’ Blue Origin, or Branson’s Virgin Galactic, I would have assured you it was a good sign of the top of the tech market, just as Japanese plans to grow mushrooms on the moon was a top in 1980s. Space and the satellite business have tended to be blackholes (pun intended) for both private and public sector. Elon Musk with his development of reusable rockets, and has greatly reduced the cost of launching satellites. On the back of this he launched his Starlink business. The transformation of satellite business have been stunning.

As the Economist article this week makes clear, Ukrainian access to Starlink has probably been one of the key factors in Ukrainian success in turning the tide of the war. Even more important, is that Starlink has continued to work despite Russian best efforts to disrupt it. This is the most important feature of the war. Musk is now in control a telecommunication network that cannot be disrupted by governments, and a telecommunication network that is better than the current satellite based networks that every other country uses. As far as I can tell, the satellites and the software used with Starlink can be easily copied. The real key is the ability to launch many satellites quickly and cheaply. That is SpaceX is really the valuable asset, not Starlink. The military implication is that every country that wishes to have an independent military, needs to develop its own SpaceX program. China and India definitely, Russia probably, Europe and Japan maybe. I think it will be reasonable to expect in 10 years time, that there will 3 or 4 SpaceXs operating, and that global launches to space could be almost a daily event. I am pretty sure, this will not be a profitable venture, but as it is necessary for military advantage, it will happen anyway. One area that should see surging demand is rocket fuel – and particularly liquid oxygen. Space travel is a new area of research for me, but the internet suggest Air Liquide and Air Products (the clue is in the name) are key supplies of liquid oxygen, and both stocks have been reassuringly good performers.

Thinking more long term, the emergence of competitive satellite business with limited latency and/or ability to be disrupted will have significance consequences for land based telecommunication businesses. The current mobile phone base tower businesses have been built around monopolising the best area for base towers, and the getting mobile phone companies to agree CPI + price agreements over many years. And like any good short idea, they have been reassuringly weak.

When Russia originally invaded Ukraine, I worried that this would lead China to either join Russia, or catalyse a Chinese invasion of Taiwan. The military success of Starlink, makes this seem less likely to me. So this is bullish in some respects. But Starlink is going to cause a new arms/space race, and within that I can see a good trade in long space fuel, and short tower companies. Space fuel is commodity linked, and tower companies were seen as bond proxies for years, so after all that, I end up back with a surrogate long GLD/short TLT trade. That’s still fine by me – hopefully for you too. Space is a mega trade, that seems to fit into the political environment of a shift to pro-labour. Maybe I should set up a fund – but in the mean time, I will keep publishing my ideas here.

Loading…