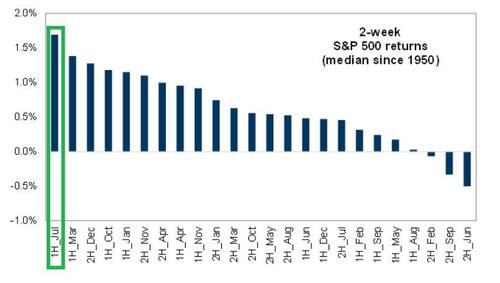

On the one hand, what was the most bullish case for markets starting this month fizzled with a bang, when after a solid start to July and the best start to Q3 since 1980, stocks resumed their bear market slide, only to recover some losses toward the end of the week. In any case, the barely 1% rise in the first half of July was at best meh considering the lofty expectations for what has traditionally been the best two-week period of the year...

... for markets.

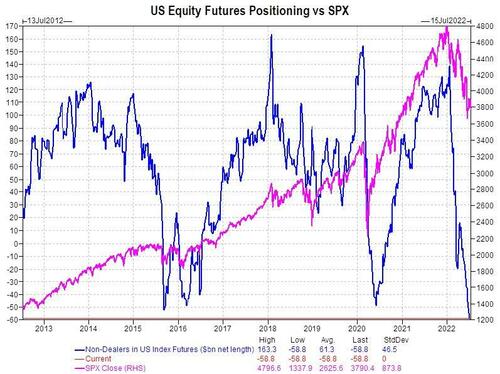

So as attention turns from what was a big dud of a strong calendar period, to what is already shaping up as a disappointing Q2 earnings season (with virtually all banks missing expectations across the board), the bulls are once again in retreat, and nowhere is this more obvious than in hedge fund positioning which according to Goldman's Scott Rubner, "is so low, it has officially fallen off my chart." Rubner then invites readers to take a look at some of this stuff, and points to Goldman's Prime Broker hedge fund exposure, Futures Positioning, CTA, Risk Parity, noting that "I don’t think there is more marginal position left to sell, given large hedges vs. fundamental positions already in play."

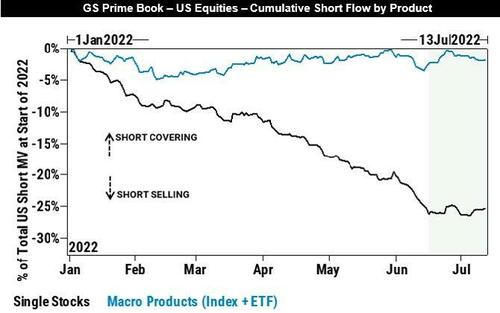

Indeed, digging into the dispersion between single stocks and macro products we find that a record divergence where there has been little shorting at the index and ETF level, but nearly record shorting at t the single stock level!

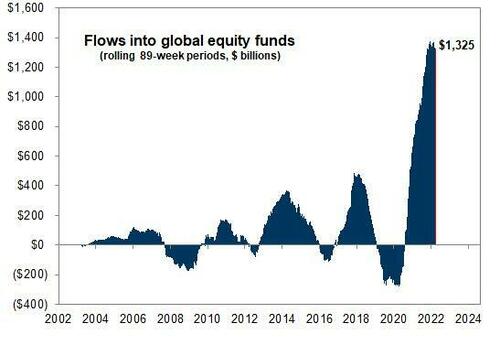

Meanwhile, away from increasingly bearish institutions, we noted lat week that retail investors are close to capitulating, but not quite yet, and according to Goldman, households - which represent "the most important investor in the markets" have not yet capitulated and remain in HODL mode, with "that $1.325 Trillion worth of “cumulative net inflows” remaining a cement block."

And until that massive wall of inflows refuses to budge, there is little risk of a liquidation flush. On the contrary, with sentiment crashing through the floor, it is far more likely that stocks are due for another (bear market) rally and/or short squeeze. All they need is a catalyst, especially since markets digested the risk of a 100bps rate hike and actually rose on the news.

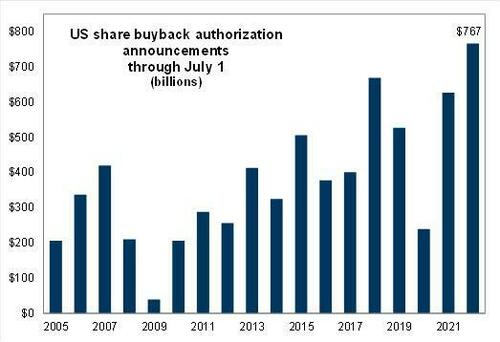

That catalyst may be the return of buybacks: according to Goldman, stocks will see a whopping $300B worth of US Corporate buyback execution in Q3 (Q2 data is still TBD but Q1 was $312BN for all US stocks). Some math:

- Days in Q3 = 61

- Days in Q3 open window 55

- $300B / 55 = $5.5B per day, every day, starting on July 22nd. VWAP + VOL muting.

The fundamental question, does $5.5B worth of demand, help mute overall earnings guidance weakness per diem? According to Ruber "the answer is yes" but that's to be expected, after all he is the resident Goldman permabull and the bank's equivalent of JPM's Marko Kolanovic.

In conclusion, Rubner sums up current sentiment as follows:

- The bearish trade is very consensus, when I talk about very consensus, I mean very very consensus. I got more pings this week, than any week of 2022.

- The bearish view is already reflected in current market positioning and extreme over hedges.

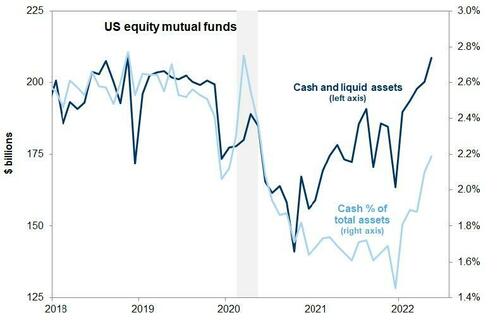

Bonus chart from Rubner who notes that "this is cash levels (money markets + mutual fund cash) – this is elevated and looking for dip alpha."

On the one hand, what was the most bullish case for markets starting this month fizzled with a bang, when after a solid start to July and the best start to Q3 since 1980, stocks resumed their bear market slide, only to recover some losses toward the end of the week. In any case, the barely 1% rise in the first half of July was at best meh considering the lofty expectations for what has traditionally been the best two-week period of the year…

… for markets.

So as attention turns from what was a big dud of a strong calendar period, to what is already shaping up as a disappointing Q2 earnings season (with virtually all banks missing expectations across the board), the bulls are once again in retreat, and nowhere is this more obvious than in hedge fund positioning which according to Goldman’s Scott Rubner, “is so low, it has officially fallen off my chart.” Rubner then invites readers to take a look at some of this stuff, and points to Goldman’s Prime Broker hedge fund exposure, Futures Positioning, CTA, Risk Parity, noting that “I don’t think there is more marginal position left to sell, given large hedges vs. fundamental positions already in play.”

Indeed, digging into the dispersion between single stocks and macro products we find that a record divergence where there has been little shorting at the index and ETF level, but nearly record shorting at t the single stock level!

Meanwhile, away from increasingly bearish institutions, we noted lat week that retail investors are close to capitulating, but not quite yet, and according to Goldman, households – which represent “the most important investor in the markets” have not yet capitulated and remain in HODL mode, with “that $1.325 Trillion worth of “cumulative net inflows” remaining a cement block.”

And until that massive wall of inflows refuses to budge, there is little risk of a liquidation flush. On the contrary, with sentiment crashing through the floor, it is far more likely that stocks are due for another (bear market) rally and/or short squeeze. All they need is a catalyst, especially since markets digested the risk of a 100bps rate hike and actually rose on the news.

That catalyst may be the return of buybacks: according to Goldman, stocks will see a whopping $300B worth of US Corporate buyback execution in Q3 (Q2 data is still TBD but Q1 was $312BN for all US stocks). Some math:

- Days in Q3 = 61

- Days in Q3 open window 55

- $300B / 55 = $5.5B per day, every day, starting on July 22nd. VWAP + VOL muting.

The fundamental question, does $5.5B worth of demand, help mute overall earnings guidance weakness per diem? According to Ruber “the answer is yes” but that’s to be expected, after all he is the resident Goldman permabull and the bank’s equivalent of JPM’s Marko Kolanovic.

In conclusion, Rubner sums up current sentiment as follows:

- The bearish trade is very consensus, when I talk about very consensus, I mean very very consensus. I got more pings this week, than any week of 2022.

- The bearish view is already reflected in current market positioning and extreme over hedges.

Bonus chart from Rubner who notes that “this is cash levels (money markets + mutual fund cash) – this is elevated and looking for dip alpha.”