Biden administration economists are pushing for federal pressure to ease zoning restrictions at the local level, an attempt to address the terrible housing affordability conditions afflicting the nation.

This week, top Biden administration economists released their annual Economic Report of the President. The 487-page document attempts to illustrate the current state of the economy and what might be done to improve various aspects of it.

The report, rolled out with relatively little fanfare, devotes more than two dozen pages to increasing the supply of housing, something that has gained more attention as sky-high mortgage rates and rising home costs price out an increasing number of families.

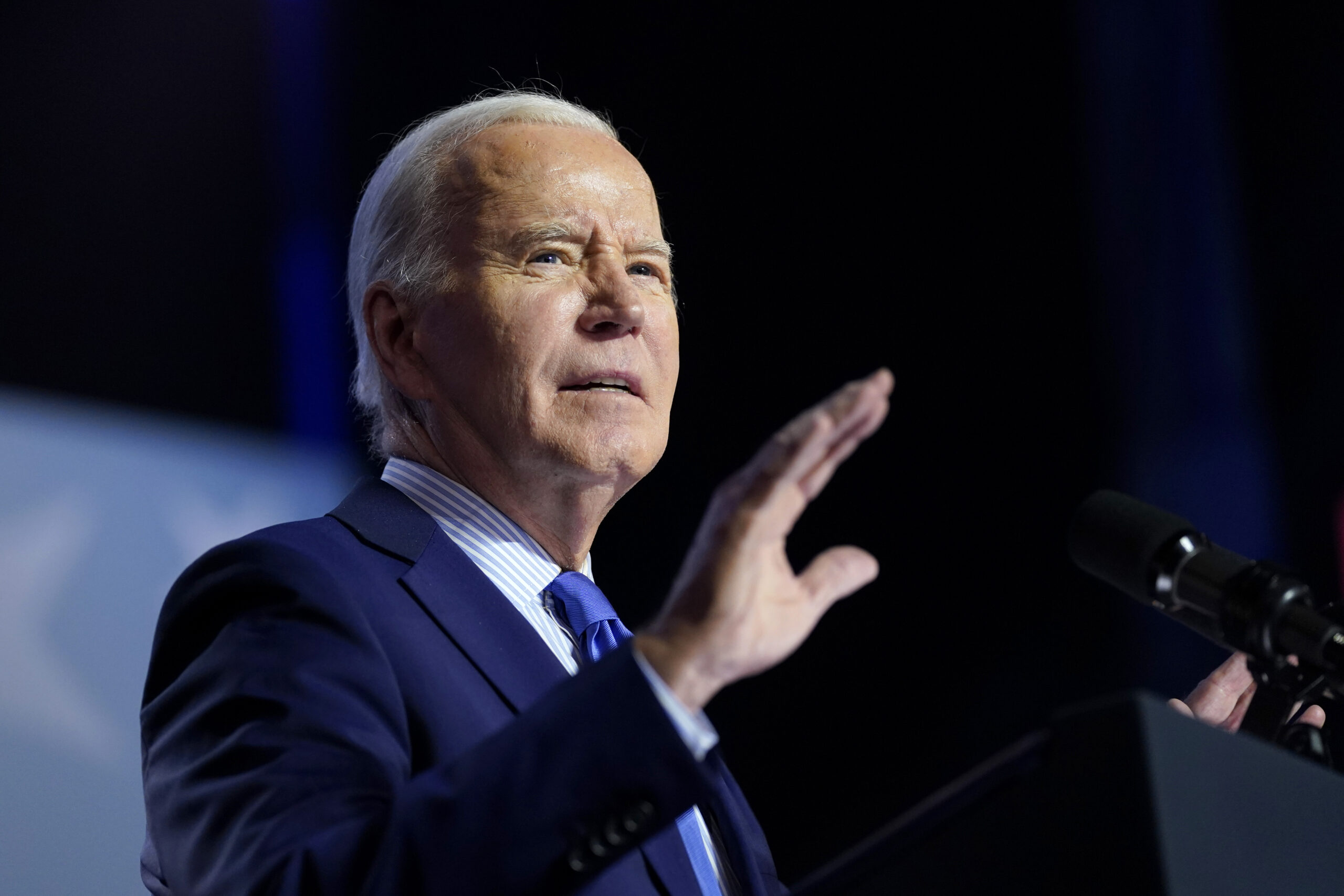

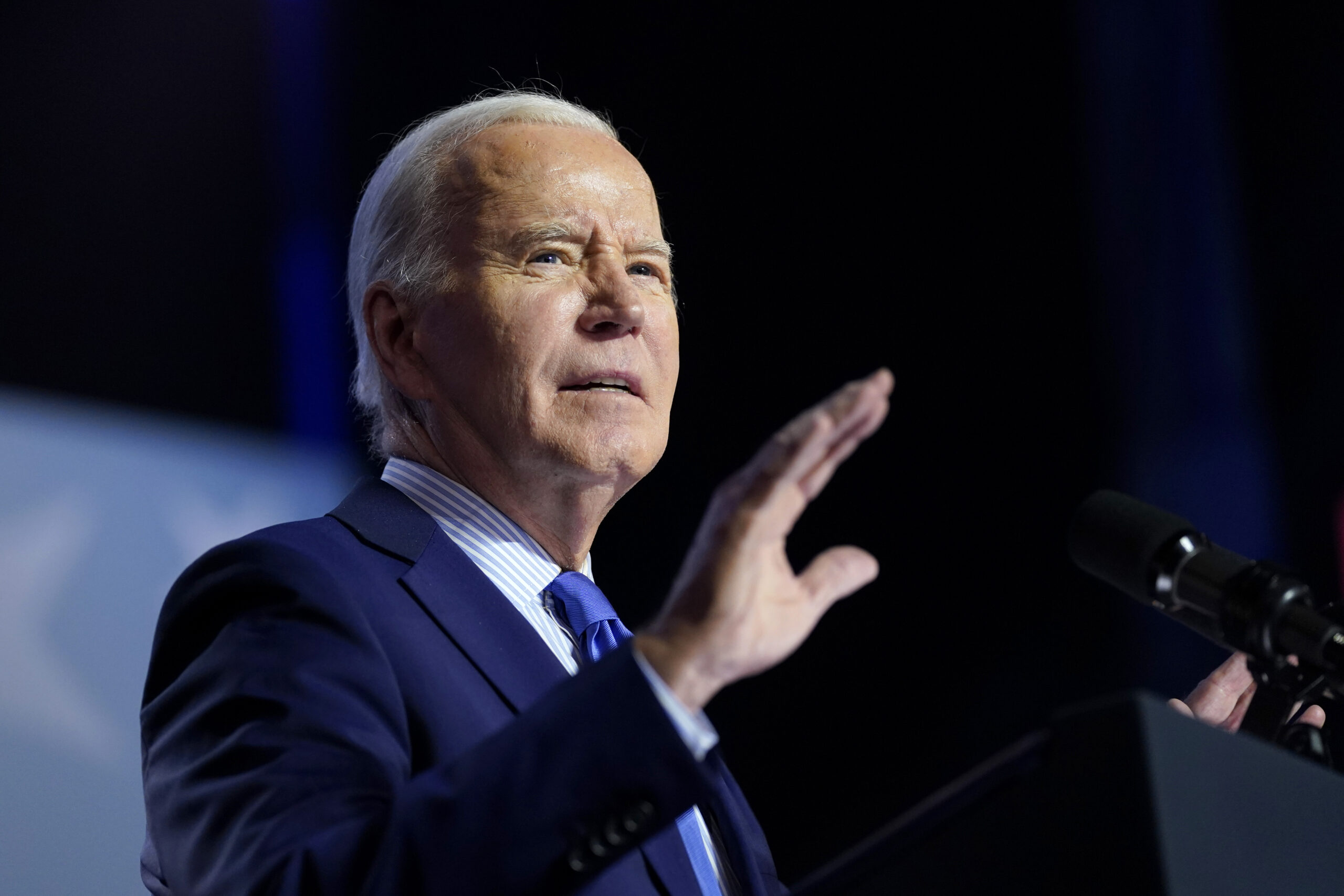

The report includes several recommendations that are already part of President Joe Biden’s housing agenda, but perhaps most notably, proposes that the federal government become more aggressive in intervening in local affairs to encourage changes to zoning regulations.

Basically, the White House and most economists say that a major problem for the housing market is that ordinances prevent the construction of more homes or feature regulations that restrict construction of multifamily housing.

The administration wants to use federal funding as leverage to push communities to ease strict zoning restrictions, and the report discusses some of the administration’s efforts.

For instance, in his recent budget, Biden also called for $20 billion in competitive grants to incentivize state and local jurisdictions and tribes to expand supply.

Also, the Pathways to Removing Obstacles to Housing program will award $85 million in competitive grants to localities that present plans to remove barriers to affordable housing and production in 2024.

Kevin Corinth is a former chief economist in the Trump White House’s Council of Economic Advisers. He told the Washington Examiner after the report’s release that he thought the chapter on housing did a good job in diagnosing the problem with zoning and housing supply, although he disagrees with how the White House economists see the role of the federal government in the situation.

“The thing that they get at that is more controversial is using federal government grants to localities as sort of a carrot for making reforms,” Corinth said. “They talk about kind of micromanaging localities, saying if they make specific changes to their zoning codes then they would get this carrot of federal funding.”

The report says positive change in the housing market can be exacted by using those carrots.

“Federal dollars can create incentives for state and local policymakers to meet housing policy goals,” the economists said in this year’s Economic Report of the President.

The push to curb local constraints to supply was also seen during the Trump administration. Housing and Urban Development Secretary Ben Carson declared himself a “YIMBY” — that is, an advocate of saying “yes in my backyard” to housing. The former president himself also signed an executive order on reducing regulatory barriers to new housing, although he backtracked on that during the 2020 presidential election and later defended zoning laws.

Corinth, who is now a senior fellow at the American Enterprise Institute, said the latest report does a good job presenting just how big of an issue housing supply has become, particularly against the backdrop of rising home prices and prohibitive mortgage rates, which are hovering around 7%, more than double than the lows notched in the pandemic.

The White House economists noted that the fraction of all new single-family homes under 1,400 square feet, essentially starter homes that are needed to let people first get their foot into the housing market, declined from nearly 40% of construction in the early 1970s to about 7% in the early 2020s, a dramatic plunge.

The report also speaks about how zoning constraints, which have become increasingly prohibitive in many local areas, are making construction of affordable housing more challenging.

The White House says “exclusionary zoning policies” constrain supply and decrease affordability.

“Examples include prohibitions on multifamily homes, height limits, minimum lot sizes, square footage minimums, and parking requirements—each of which functions to constrain housing and population density,” the report reads.

“When land-use restrictions drive supply constraints, growing housing demand in cities and neighborhoods leads to more expensive housing, rather than new housing development,” the economists added.

Jared Bernstein, the chairman of the White House Council of Economic Advisers, said during a recent interview that it is difficult to make a meaningful difference in housing affordability without going after land-use regulations.

“I feel like we’re kicking through more of an open door now than we ever have before,” he told the New York Times.

Other parts of the report, though, focus on Biden proposals that many economists say would more likely affect demand and could even exacerbate the situation with housing affordability. Biden proposed these in his 2025 budget.

One White House idea is a $5,000 tax credit for middle-class first-time homebuyers for two years, described as a form of mortgage relief. Biden also pitched a $10,000 credit for those who sell their starter homes. The administration described that credit as a response to the decrease in supply because pandemic-era homebuyers aren’t putting their homes on the market because of the higher mortgage rates.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Some say, though, that the Biden plan would backfire by increasing demand, putting upward pressure on home prices. Mark Calabria, the former director of the Federal Housing Finance Agency, recently told the Washington Examiner that the Biden plan could make the situation worse.

“These things are ultimately going to increase demand when fundamentally the problem is supply,” Calabria said. “Econ 101. If you juice up demand, you’re not going [to] increase sales. You’re just going to increase prices. You’re not helping anybody.”