Economic output growth for the fourth quarter of 2023 was revised down by a tenth of a percentage point to a 3.2% seasonally adjusted annual rate, showing that commerce remained brisk to end the year despite the difficulties created by the Federal Reserve‘s interest rate policies.

The new data, adjusted for inflation, were published Wednesday by the Bureau of Economic Analysis in its report for gross domestic product for the fourth quarter and for all of last year. The data showed the economy expanded 2.5% for all of 2023.

The Bureau of Economic Analysis releases three revisions to its GDP estimates, with the final one coming in March.

The report shows that the economy fared much better in 2023 than was expected. Earlier in the year, officials at the Fed were projecting that GDP growth would only grow minimally.

Taken as a whole, the latest report shows that the economy was able to side-step a recession that many economists had predicted would hit sometime last year and remained strong into the final quarter of 2023. The numbers indicate that the economy, flush with continued spending, hummed right along despite the pressures of inflation and high interest rates.

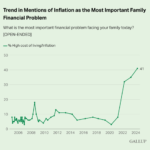

President Joe Biden will tout the annual GDP growth as proof that his “Bidenomics” agenda is working — even despite his economic approval rating being down and voters consistently expressing concerns for the state of the economy.

The Fed began hiking the federal funds rate in March 2022 in response to inflation, which began rising in the middle of 2021 and soon grew into an inflationary tsunami the likes of which hadn’t been seen in generations. At its peak, price growth crested at about an 9% annual pace.

Since then, inflation has fallen to a 3.1% rate, according to the latest consumer price index numbers for January. That is still above the Fed’s preferred 2% level, although shows that the central bank’s nearly two-year quest to tamp down inflation by raising interest rates has borne results.

The economy has also added jobs every single month since December 2020. When the Fed began raising rates, many economists expected there to be resulting job loss, but the labor market held up and even surpassed expectations many months over the past couple of years.

The economy once again blew past expectations in January and added 353,000 more jobs, the Bureau of Labor Statistics found. The unemployment rate remained at 3.7%, a figure that is historically low.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Investors overwhelmingly expect the Fed to once again hold rates steady following the March meeting of the Federal Open Market Committee, according to the CME Group’s FedWatch tool, which calculates the probability using futures contract prices for rates in the short-term market targeted by the Fed.

When the Fed meets in May, investors peg a greater than 83% probability that interest rates will remain the same as they are now. The pivot, investors are betting, is most likely to occur following the central bank’s June gathering, or perhaps even in July.