Tuesday was a jammed-packed day for food protectionism developments across Asia. India announced a sugar export ban, and Malaysia halted shipments of chicken. Like many others in the region, both countries suffer from high inflation. Each respective government and central bank seeks to suppress inflation, and what appears to be the move at the moment (besides raising interest rates) are protectionist measures.

If inflation continues to run hot in these countries, the risk of socio-economic turmoil increases.

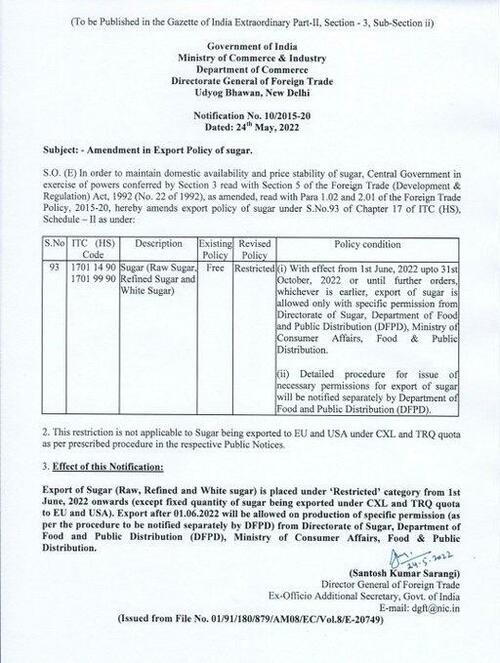

Today's events first began with India. Bloomberg reported earlier that sources expected a sugar export ban was imminent. The Indian government announced the new trade restrictions late in the US cash session. Following India's lead, Malaysia announced trade restrictions on chickens to curtail rising prices.

We suspect more countries to announce protectionist measures to quell food inflation, though such trade restrictions will only exacerbate food insecurity worldwide.

* * *

Update: India, the world's second-biggest sugar producer, will cap sugar exports at ten million tons during the current sugar season (2021-22). It's another attempt to contain inflation and stabilize domestic prices.

"Taking into consideration unprecedented growth in exports of sugar and the need to maintain sufficient stock of sugar in the country as well as to safeguard interests of the common citizens of the country by keeping prices of sugar under check, Government of India has decided to regulate sugar exports from June 1, 2022," Consumer Affairs Ministry said.

The ministry will allow only 10 million tons of sugar exports for the season that ends in Sept. 2022. Sugar mills have already contracted 9 million tons, and a record 7.8 million tons have already been shipped.

India's curbs on sugar exports follow another protectionist step as wheat exports were restricted earlier this month. The government is trying to get a handle on soaring food inflation by ensuring adequate domestic supplies.

Breaking: After banning wheat export, India curbs sugar export to 10 mn tonne this season, another protectionist step as the country battles runaway inflation. Consumers prices in April climbed to an 8-yr high of 7.79%, overshooting the .@RBI’s target of 6% for 4 straight months.

— Zia Haq (@ziahaq) May 24, 2022

India's government is on a protectionist roll. What crop will they ban for export next?

* * *

Food protectionism soars and will continue worldwide through 2022, exacerbating food security risks for the world's most vulnerable countries. One country safeguarding its food supplies is India.

Earlier this month, India's government halted wheat exports amid heatwaves threatened crop yields. Another act of protectionism could be announced in the coming days with an export restriction on sugar, according to Bloomberg.

A person familiar with the new trading restrictions says the government plans to announce a ten million ton cap on sugar exports through September. The move guarantees that domestic stockpiles are adequate ahead of the next growing season in October.

India is the second-largest sugar exporter behind Brazil. Its largest customers include Bangladesh, Indonesia, Malaysia, and Dubai.

Bloomberg notes the proposed sugar trade restriction "appears to be an extreme case of precaution:"

India is expected to produce 35 million tons this season and consume 27 million tons, according to the Indian Sugar Mills Association. Including last season's stockpiles of about 8.2 million tons, it has a surplus of 16 million, including as much as 10 million for exports.

India rarely shipped more than 7 million tons until last year, when exports hit a record 7.2 million. Sugar mills tended to rely on government subsidies to boost exports. However, global prices have jumped almost 20% in the past year, allowing India to increase shipments without subsidies. There are expectations for exports to range between 9 million and 11 million tons this season.

The person said once shipments reach 9 million tons. Exporters will have to submit paperwork to the government to apply for permits to send the remaining 1 million tons. They added the export halt could support global sugar market prices.

Besides increasing protectionism in India, Indonesia's ban on palm oil exports roiled edible oil markets for a month (the restriction has since been reversed). Malaysia also announced to halt 3.6 million chickens a month from June 1 and increase wheat imports to stabilize prices.

The trend is clear: Food protectionism will exacerbate the global food crisis, creating headaches for governments and central banks desperately trying to curb inflation before it becomes unmanageable and results in socio-economic turmoil.

Tuesday was a jammed-packed day for food protectionism developments across Asia. India announced a sugar export ban, and Malaysia halted shipments of chicken. Like many others in the region, both countries suffer from high inflation. Each respective government and central bank seeks to suppress inflation, and what appears to be the move at the moment (besides raising interest rates) are protectionist measures.

If inflation continues to run hot in these countries, the risk of socio-economic turmoil increases.

Today’s events first began with India. Bloomberg reported earlier that sources expected a sugar export ban was imminent. The Indian government announced the new trade restrictions late in the US cash session. Following India’s lead, Malaysia announced trade restrictions on chickens to curtail rising prices.

We suspect more countries to announce protectionist measures to quell food inflation, though such trade restrictions will only exacerbate food insecurity worldwide.

* * *

Update: India, the world’s second-biggest sugar producer, will cap sugar exports at ten million tons during the current sugar season (2021-22). It’s another attempt to contain inflation and stabilize domestic prices.

“Taking into consideration unprecedented growth in exports of sugar and the need to maintain sufficient stock of sugar in the country as well as to safeguard interests of the common citizens of the country by keeping prices of sugar under check, Government of India has decided to regulate sugar exports from June 1, 2022,” Consumer Affairs Ministry said.

The ministry will allow only 10 million tons of sugar exports for the season that ends in Sept. 2022. Sugar mills have already contracted 9 million tons, and a record 7.8 million tons have already been shipped.

India’s curbs on sugar exports follow another protectionist step as wheat exports were restricted earlier this month. The government is trying to get a handle on soaring food inflation by ensuring adequate domestic supplies.

Breaking: After banning wheat export, India curbs sugar export to 10 mn tonne this season, another protectionist step as the country battles runaway inflation. Consumers prices in April climbed to an 8-yr high of 7.79%, overshooting the .@RBI’s target of 6% for 4 straight months.

— Zia Haq (@ziahaq) May 24, 2022

India’s government is on a protectionist roll. What crop will they ban for export next?

* * *

Food protectionism soars and will continue worldwide through 2022, exacerbating food security risks for the world’s most vulnerable countries. One country safeguarding its food supplies is India.

Earlier this month, India’s government halted wheat exports amid heatwaves threatened crop yields. Another act of protectionism could be announced in the coming days with an export restriction on sugar, according to Bloomberg.

A person familiar with the new trading restrictions says the government plans to announce a ten million ton cap on sugar exports through September. The move guarantees that domestic stockpiles are adequate ahead of the next growing season in October.

India is the second-largest sugar exporter behind Brazil. Its largest customers include Bangladesh, Indonesia, Malaysia, and Dubai.

Bloomberg notes the proposed sugar trade restriction “appears to be an extreme case of precaution:”

India is expected to produce 35 million tons this season and consume 27 million tons, according to the Indian Sugar Mills Association. Including last season’s stockpiles of about 8.2 million tons, it has a surplus of 16 million, including as much as 10 million for exports.

India rarely shipped more than 7 million tons until last year, when exports hit a record 7.2 million. Sugar mills tended to rely on government subsidies to boost exports. However, global prices have jumped almost 20% in the past year, allowing India to increase shipments without subsidies. There are expectations for exports to range between 9 million and 11 million tons this season.

The person said once shipments reach 9 million tons. Exporters will have to submit paperwork to the government to apply for permits to send the remaining 1 million tons. They added the export halt could support global sugar market prices.

Besides increasing protectionism in India, Indonesia’s ban on palm oil exports roiled edible oil markets for a month (the restriction has since been reversed). Malaysia also announced to halt 3.6 million chickens a month from June 1 and increase wheat imports to stabilize prices.

The trend is clear: Food protectionism will exacerbate the global food crisis, creating headaches for governments and central banks desperately trying to curb inflation before it becomes unmanageable and results in socio-economic turmoil.