It may come as a surprise to some but the head US trader of the same bank that spawns mARKKo Kolanovic's weekly bullishness, is also one of the most bearish market commentators. Below is the trading desk commentary for JPM's Elan Luger, head of US trading.

The most positive thing I can say about this market is that what had been heavily debated in Q1 is now the overwhelming consensus. Everyone is a bear. China is shutdown, inflation is running wild, Russia / Ukraine continues to impact supply chains, animal spirits are dead, the fed has lost control, QT is coming, a recession is coming, performance is terrible, privates aren’t marked right... did I miss anything?

Our running assumption has been “fair value” for this market is ~$4200 which is 15-16x 2023 EPS which was the multiple the last time the 10 year was at 3%.

With all of the above risks, investors will likely require a healthy discount to fair value before getting excited about equities again. Whether that level is 4000, 3800, or 3600 I haven’t a clue, but we are getting closer.

What I will say, is I haven’t seen investors as unanimously bearish since ’08. And we all know, there is no rally like a bear market rally. Maybe this week’s CPI is the catalyst?

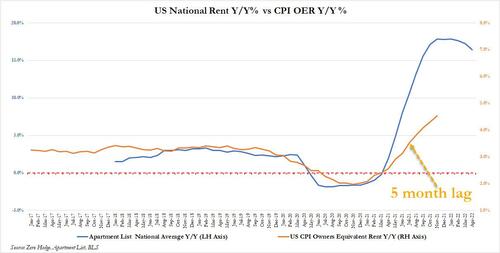

Maybe... because not only will the April CPI be a big drop from March (consensus at 8.1% down from 8.5% Y?Y, mostly due to base effects), but more importantly, in addition to the reversal in soaring used car prices, we can now confirm that the peak in rental growth is also behind us.

We'll have more to discuss on peak CPI in a subsequent post.

It may come as a surprise to some but the head US trader of the same bank that spawns mARKKo Kolanovic’s weekly bullishness, is also one of the most bearish market commentators. Below is the trading desk commentary for JPM’s Elan Luger, head of US trading.

The most positive thing I can say about this market is that what had been heavily debated in Q1 is now the overwhelming consensus. Everyone is a bear. China is shutdown, inflation is running wild, Russia / Ukraine continues to impact supply chains, animal spirits are dead, the fed has lost control, QT is coming, a recession is coming, performance is terrible, privates aren’t marked right… did I miss anything?

Our running assumption has been “fair value” for this market is ~$4200 which is 15-16x 2023 EPS which was the multiple the last time the 10 year was at 3%.

With all of the above risks, investors will likely require a healthy discount to fair value before getting excited about equities again. Whether that level is 4000, 3800, or 3600 I haven’t a clue, but we are getting closer.

What I will say, is I haven’t seen investors as unanimously bearish since ’08. And we all know, there is no rally like a bear market rally. Maybe this week’s CPI is the catalyst?

Maybe… because not only will the April CPI be a big drop from March (consensus at 8.1% down from 8.5% Y?Y, mostly due to base effects), but more importantly, in addition to the reversal in soaring used car prices, we can now confirm that the peak in rental growth is also behind us.

We’ll have more to discuss on peak CPI in a subsequent post.