The question that wealth managers are getting across the nation is: “Where can I go to stop getting poorer?”

Where indeed?

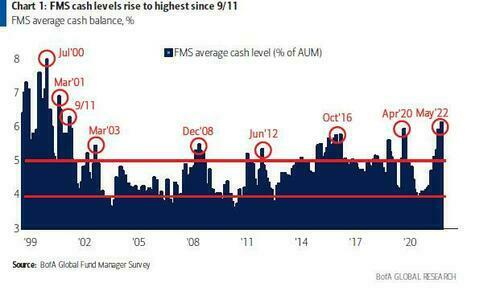

As institutional investors continue to dump stocks to cash...

...Corporate insiders have been buying...

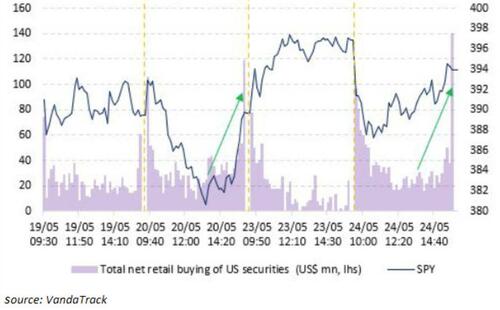

... and as Vanda notes, the panic-bid-ramps in the last few days have been driven largely by retail traders...

...retail seem to be behind the quick late afternoon recoveries in the S&P 500 in the last few days.

We suspect that institutional asset managers were the cohort of investors reducing equity allocations in the morning last Friday and yesterday, while retail aggressively bought the dip towards the end of the trading session.

The large inflows from retail towards the end of the day – without additional selling pressure from institutional investors - were probably the main force behind these sharp intraday rebounds.

However, as The Wall Street Journal reports, retail 'investors' are suffering greatly as the market meltdown accelerates, with some wondering if they will live long enough to see their investments recover.

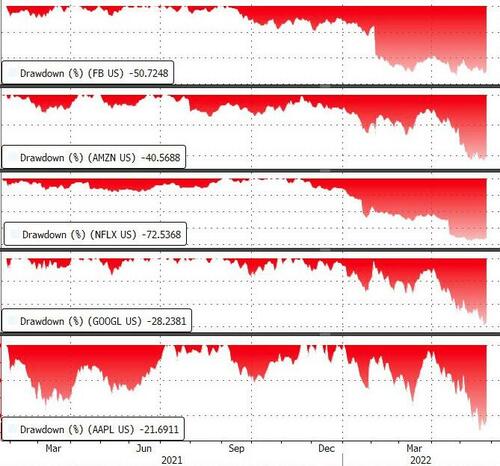

As a reminder, the Nasdaq is suffering its largest drawdown since the great financial crisis and the S&P 500 is teetering on the brink of a bear market (while under the surface a number of the largest companies in the world are down very dramatically)...

The collapse in these widely-held stocks have sparked shock and horror among America's investing class who have enjoyed a decade on 'easy street', buying every dip knowing The Fed will always be there for them.

WSJ cites one asset manager whose retired clients have thrown in the towel and moved to cash:

“Those people were not in a good place,” said the CIO.

“They had a lot of anxiety about goals and dreams and being able to live their lifestyles.”

Another investor, Craig Bartels, a 46-year-old real-estate broker in Zionsville, Ind., looked to the distant past for advice, reading Ray Dalio’s recent book on economic history and Adrian Goldsworthy’s “How Rome Fell: Death of a Superpower.”

“This sounds like us right now,” he thought, adding that:

“I don’t think we’re anywhere near the bottom."

Another investor, who lives in Manhattan, exclaimed:

“When you’re banking on that money saved over your lifetime to carry you through and it starts to go away, you feel helpless,” he said.

“I don’t want to go back to work at 66.”

Many investors, like Susan Wagner, a recent retiree, have taken their retirement money out of the markets altogether this month.

“The anxiety was literally me losing sleep, tossing and turning at night wondering how much more we were going to lose,” Ms. Wagner said. Her wife, a former radiologist, was hesitant but eventually agreed.

“It was too nerve-racking, and I was quite emotional about it,” Ms. Wagner said.

“I was very upset by what was happening.”

Perhaps most notably, veteran bond trader Rick Reider, head of BlackRock's massive fixed income group, admits that:

"My stomach is churning all day,” adding that "there are so many crosscurrents of uncertainty, and we aren’t going to get closure on any of them for weeks, if not months.”

Simply put, professional and amateur investor alike - everyone is clueless (and shocked) when The Fed does not have your back.

And for an anecdote of that 'cluelessness, one so-called 'economist' is quoted as saying in the WSJ article:

"The Fed is going too far, inflation is a nightmare and the real-estate market is going to crash."

So what is it that you want 'Mrs.Economist'?

Former Dallas Fed president Richard Fisher said it best in January:

"Let's face it Joe, I want to come back to the alcohol metaphor we started with, the market has been wearing beer goggles for the longest possible time...and they just assume the Fed's going to bail them out. I think the strike price on the Fed put has moved significantly...and unless we have a dramatic turn in the markets that indicates it can infect the real economy, I don't believe - under this chair in particular who has a credit market background - that they will be weak in following through on what they pronounced."

"The market has been wearing beer goggles for the longest possible time. Everything looks beautiful because money was free. They just assume the Fed is going to bail them out. The strike price on the Fed put has moved significantly," says Richard Fisher. pic.twitter.com/VgPUzGQaB8

— Squawk Box (@SquawkCNBC) January 27, 2022

Back in February 2020, he offered some more thoughts about Wall Street's 'lost generation'.

"The Fed has created this dependency and there's an entire generation of money-managers who weren't around in '74, '87, the end of the '90s, and even 2007-2009.. and have only seen a one-way street... of course they're nervous."

"The question is - do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?"

As we warned at the time, if Fisher is correct, however, that would be bad news for the generation of Wall Street traders who still have never faced a drawn-out bear market in equities (just swift and vicious bear-market corrections like we saw in February and March 2020). If the Fed truly is intent on abandoning the "Fed put", then two-way volatility might finally become a more regular feature in equity markets.

It appears after a ten-year consequence-free party, the hangover is here.

The question that wealth managers are getting across the nation is: “Where can I go to stop getting poorer?”

Where indeed?

As institutional investors continue to dump stocks to cash…

…Corporate insiders have been buying…

… and as Vanda notes, the panic-bid-ramps in the last few days have been driven largely by retail traders…

…retail seem to be behind the quick late afternoon recoveries in the S&P 500 in the last few days.

We suspect that institutional asset managers were the cohort of investors reducing equity allocations in the morning last Friday and yesterday, while retail aggressively bought the dip towards the end of the trading session.

The large inflows from retail towards the end of the day – without additional selling pressure from institutional investors – were probably the main force behind these sharp intraday rebounds.

However, as The Wall Street Journal reports, retail ‘investors’ are suffering greatly as the market meltdown accelerates, with some wondering if they will live long enough to see their investments recover.

As a reminder, the Nasdaq is suffering its largest drawdown since the great financial crisis and the S&P 500 is teetering on the brink of a bear market (while under the surface a number of the largest companies in the world are down very dramatically)…

The collapse in these widely-held stocks have sparked shock and horror among America’s investing class who have enjoyed a decade on ‘easy street’, buying every dip knowing The Fed will always be there for them.

WSJ cites one asset manager whose retired clients have thrown in the towel and moved to cash:

“Those people were not in a good place,” said the CIO.

“They had a lot of anxiety about goals and dreams and being able to live their lifestyles.”

Another investor, Craig Bartels, a 46-year-old real-estate broker in Zionsville, Ind., looked to the distant past for advice, reading Ray Dalio’s recent book on economic history and Adrian Goldsworthy’s “How Rome Fell: Death of a Superpower.”

“This sounds like us right now,” he thought, adding that:

“I don’t think we’re anywhere near the bottom.”

Another investor, who lives in Manhattan, exclaimed:

“When you’re banking on that money saved over your lifetime to carry you through and it starts to go away, you feel helpless,” he said.

“I don’t want to go back to work at 66.”

Many investors, like Susan Wagner, a recent retiree, have taken their retirement money out of the markets altogether this month.

“The anxiety was literally me losing sleep, tossing and turning at night wondering how much more we were going to lose,” Ms. Wagner said. Her wife, a former radiologist, was hesitant but eventually agreed.

“It was too nerve-racking, and I was quite emotional about it,” Ms. Wagner said.

“I was very upset by what was happening.”

Perhaps most notably, veteran bond trader Rick Reider, head of BlackRock’s massive fixed income group, admits that:

“My stomach is churning all day,” adding that “there are so many crosscurrents of uncertainty, and we aren’t going to get closure on any of them for weeks, if not months.”

Simply put, professional and amateur investor alike – everyone is clueless (and shocked) when The Fed does not have your back.

And for an anecdote of that ‘cluelessness, one so-called ‘economist’ is quoted as saying in the WSJ article:

“The Fed is going too far, inflation is a nightmare and the real-estate market is going to crash.”

So what is it that you want ‘Mrs.Economist’?

Former Dallas Fed president Richard Fisher said it best in January:

“Let’s face it Joe, I want to come back to the alcohol metaphor we started with, the market has been wearing beer goggles for the longest possible time…and they just assume the Fed’s going to bail them out. I think the strike price on the Fed put has moved significantly…and unless we have a dramatic turn in the markets that indicates it can infect the real economy, I don’t believe – under this chair in particular who has a credit market background – that they will be weak in following through on what they pronounced.”

“The market has been wearing beer goggles for the longest possible time. Everything looks beautiful because money was free. They just assume the Fed is going to bail them out. The strike price on the Fed put has moved significantly,” says Richard Fisher. pic.twitter.com/VgPUzGQaB8

— Squawk Box (@SquawkCNBC) January 27, 2022

Back in February 2020, he offered some more thoughts about Wall Street’s ‘lost generation’.

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, and even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

As we warned at the time, if Fisher is correct, however, that would be bad news for the generation of Wall Street traders who still have never faced a drawn-out bear market in equities (just swift and vicious bear-market corrections like we saw in February and March 2020). If the Fed truly is intent on abandoning the “Fed put”, then two-way volatility might finally become a more regular feature in equity markets.

It appears after a ten-year consequence-free party, the hangover is here.