By Philip Marey of Rabobank

Summary

-

After leaking to the press earlier this week, today’s FOMC’s decision to raise the target range for the federal funds rate by 75 bps came as no surprise.

-

At the press conference, Powell said he did not expect 75 bps to be common, but he also said that a 50 to 75 bps move was most likely at the next meeting.

-

Powell said that the Committee expected the federal funds rate to be at a modestly restrictive level of 3.0-3.5% at the end of this year, followed by more tightening next year to 3.5-4.0%.

-

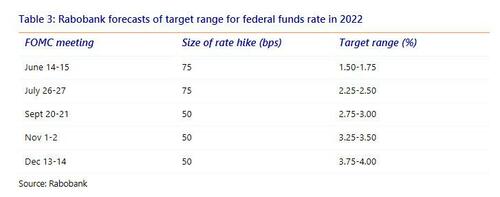

Since the Fed is still underestimating the inflation problem, not recognizing that a wage-price spiral has already started, we expect they will have to raise rates faster than they now expect. We expect the target range to reach 3.75-4.00% as soon as in December.

-

We also expect the Fed will have to raise the target range for the federal funds further next year to squeeze inflation out of the economy through a recession, which we still expect to occur in the second half of 2023.

Introduction

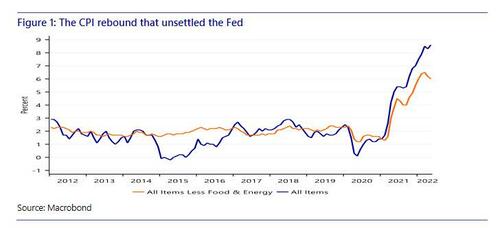

After the FOMC had spent weeks convincing the markets they were going to hike by 50 bps in June and July, early this week they leaked to the press that they were thinking about a 75 bps hike this month instead. That made all FOMC previews that banks had sent out, including our own, irrelevant. All it took was a higher than expected CPI figure (and a University of Michigan survey suggesting long-term inflation expectations were rising) last Friday. So what use is the Fed’s forward guidance if a single inflation report can make so much difference for rate policy? Unfortunately, Friday’s CPI report meant that the Fed was going to lose credibility no matter what they were going to decide. Stick to the well-telegraphed 50 bps and lose credibility as an inflation fighter, go to 75 bps and lose credibility on forward guidance.

The FOMC decided to focus on its credibility as an inflation fighter. However, this also means that forward guidance has lost its credibility. The next time the FOMC says it intends to hike by a certain amount in the next couple of meetings, we have to take it with a large grain of salt. Perhaps the Fed should just drop its forward guidance and say they will be data-dependent. If your knees are too wobbly to stick to a plan, then don’t announce it. Forward guidance may have become too detailed and the events in recent days have shown to what kind of mess this can lead. Perhaps it is better if markets learn to live again with less guidance from central banks. After all, it has become clear they don’t have a clue about what they are doing.

Statement of desperation?

The FOMC raised the target range for the federal funds rate by 75 bps to 1.50-1.75%. Esther George dissented because she preferred a 50 bps rate hike. In line with this 75 bps hike, the FOMC also raised the SRF minimum bid rate to 1.75% from 1.00% and the ON RRP offering rate to 1.55% from 0.80%. The Board of Governors raised the IORB rate to 1.65% from 0.90%.

In the formal statement, the FOMC said it is strongly committed to returning inflation to its 2% objective, replacing the sentence that the Committee expects inflation to return to its 2% objective. So a little less certain about the outcome of their fight against inflation, but even more determined. Or is this just desperation? Ironically, the FOMC said that overall economic activity appears to have picked up after edging down in the first quarter, while on the same day the Atlanta Fed revised its GDPNow-cast for Q2 downward to 0.0%. The FOMC did downgrade its GDP forecast for 2022 to 1.7% from 2.8%. But at the press conference Powell said he saw no sign of a broader slowdown in the economy. Well, if the Atlanta Fed’s nowcast is right, following -1.5% GDP growth in Q1 this means that US GDP contracted in the first half of this year. Technically not a recession if Q2 GDP growth remains non-negative, but still. This underlines the current divergence between GDP and the labor market, with the first pointing to stagnation and the second still showing solid growth. Fortunately for the US, the labor market data are more important to the NBER that formally dates business cycles.

Upward shift in dot plot, landing a little lest soft

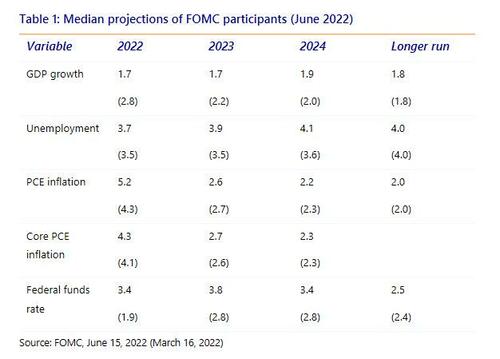

The FOMC also published an update of their economic and rate projections. Back in March, the FOMC participants expected the target range for the federal funds rate to reach a midpoint of 1.9% by the end of 2022 and 2.8% before the end of 2023. However, even with the forward guidance that the Fed provided until early this week, the federal funds rate would have reached the March projection for the end of 2022 as soon as in July. So an upward shift was necessary.

In the new dot plot, the midpoint for the federal funds rate is 3.4% at the end of 2022, 3.8% at the end of 2023, and 3.4% again at the end of 2024. The median for the neutral rate rose from 2.4% in March to 2.5% in June, back to where it was in December. This means the FOMC intends to go above neutral before the end of 2022 and peak before the end of 2023, ending 2023 at 3.8%. In 2024 they expect to cut rates back to 3.4%, which is still well above neutral. So the FOMC seems to have upgraded its peak rate by a full percentage point, while hardly changing its neutral rate. This means that they expect to go deeper into restrictive territory to bring inflation back to target.

Interestingly, the PCE forecasts for 2023 and 2024 did not change very much with PCE inflation at 2.2% in the final quarter of 2024. So the FOMC thinks the rate hikes will be enough to get inflation back toward target, after 5.2% in the final quarter of 2022. Note that in April the PCE deflator stood at 6.3%.

The GDP and unemployment data show that the FOMC still expects a soft landing with annual GDP growth not lower than 1.7% in 2022-2024 and unemployment rising to only 4.1% by the final quarter of 2024. (At present unemployment is 3.6%). However, it is still a little less soft than anticipated in March when they thought unemployment would be 3.6% in 2024 and GDP growth substantially higher in 2022-2024.

Balance sheet remains on auto-pilot

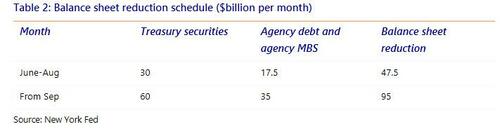

The FOMC made no change to the balance sheet normalization schedule. Balance sheet reduction finally started on June 1, well over a year since inflation started to skyrocket. Balance sheet reduction will – after a three month adjustment period – take place through monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS. This process started in June with a smaller $30 billion cap for Treasury securities and $17.5 billion cap for agency debt and agency MBS

Balance sheet reduction is on auto-pilot for now, but a decision about the sales of agency MBS will be needed somewhere along the way. According to the minutes of the May meeting, a number of participants remarked that, after balance sheet runoff was well under way, it would be appropriate for the Committee to consider sales of agency MBS to enable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities. Any program of sales of agency MBS would be announced well in advance.

75 not the new 50, but maybe again next time

During the Q&A Powell had to explain why the FOMC had abandoned its forward guidance of 50 bps. Powell said that the higher than expected CPI print on Friday, but also the upward move in long-term inflation expectations in the University of Michigan survey (see our otherwise irrelevant preview for more details about these data), warranted a 75 bps hike. He said he’d like to think that the Fed’s guidance is still credible and that it is very unusual to get such data during the blackout period. He did not expect 75 bps to be common, but he also said that a 50 to 75 bps move was most likely at the next meeting.

Powell said that the Committee expected the federal funds rate to be at a modestly restrictive level of 3.0-3.5% at the end of this year, followed by more tightening next year to 3.5-4.0%. When asked about a softish landing he pointed at the projections meeting that test, and he said that he did believe the Fed can do that. But he added that there is now a bigger chance that it depends on other factors. Powell also said the Fed was not trying to induce a recession.

Conclusion

Today the Fed tried to appear on top of things by raising the target range for the federal funds rate by 75 bps. Still, the outsized impact of a single higher than expected CPI print suggests otherwise. Since the Fed is still underestimating the inflation problem, with peak inflation the new transitory, not recognizing that a wage-price spiral has already started, we expect they will have to raise rates faster than they now expect. We expect the target range to reach 3.75-4.00%, as soon as in December. Below our forecasts for the remaining FOMC meetings of this year. However, please keep in mind that the actual course will be highly data dependent as we have seen this month.

Unfortunately, the hiking path is also likely to be followed by a recession, which we still expect to occur in the second half of 2023. As we explained in The inevitable recession, if the US economy manages to survive the onslaught of negative supply shocks (see our remarks about GDPNow above), then the Fed will finish the job because they have to squeeze out inflation. Powell said that he expects a soft landing and that the Fed is not trying to induce a recession. He also denied that there is a wage-price spiral in the US. In contrast, we think the wage-price spiral has already started, which can only be terminated by a recession.

By Philip Marey of Rabobank

Summary

-

After leaking to the press earlier this week, today’s FOMC’s decision to raise the target range for the federal funds rate by 75 bps came as no surprise.

-

At the press conference, Powell said he did not expect 75 bps to be common, but he also said that a 50 to 75 bps move was most likely at the next meeting.

-

Powell said that the Committee expected the federal funds rate to be at a modestly restrictive level of 3.0-3.5% at the end of this year, followed by more tightening next year to 3.5-4.0%.

-

Since the Fed is still underestimating the inflation problem, not recognizing that a wage-price spiral has already started, we expect they will have to raise rates faster than they now expect. We expect the target range to reach 3.75-4.00% as soon as in December.

-

We also expect the Fed will have to raise the target range for the federal funds further next year to squeeze inflation out of the economy through a recession, which we still expect to occur in the second half of 2023.

Introduction

After the FOMC had spent weeks convincing the markets they were going to hike by 50 bps in June and July, early this week they leaked to the press that they were thinking about a 75 bps hike this month instead. That made all FOMC previews that banks had sent out, including our own, irrelevant. All it took was a higher than expected CPI figure (and a University of Michigan survey suggesting long-term inflation expectations were rising) last Friday. So what use is the Fed’s forward guidance if a single inflation report can make so much difference for rate policy? Unfortunately, Friday’s CPI report meant that the Fed was going to lose credibility no matter what they were going to decide. Stick to the well-telegraphed 50 bps and lose credibility as an inflation fighter, go to 75 bps and lose credibility on forward guidance.

The FOMC decided to focus on its credibility as an inflation fighter. However, this also means that forward guidance has lost its credibility. The next time the FOMC says it intends to hike by a certain amount in the next couple of meetings, we have to take it with a large grain of salt. Perhaps the Fed should just drop its forward guidance and say they will be data-dependent. If your knees are too wobbly to stick to a plan, then don’t announce it. Forward guidance may have become too detailed and the events in recent days have shown to what kind of mess this can lead. Perhaps it is better if markets learn to live again with less guidance from central banks. After all, it has become clear they don’t have a clue about what they are doing.

Statement of desperation?

The FOMC raised the target range for the federal funds rate by 75 bps to 1.50-1.75%. Esther George dissented because she preferred a 50 bps rate hike. In line with this 75 bps hike, the FOMC also raised the SRF minimum bid rate to 1.75% from 1.00% and the ON RRP offering rate to 1.55% from 0.80%. The Board of Governors raised the IORB rate to 1.65% from 0.90%.

In the formal statement, the FOMC said it is strongly committed to returning inflation to its 2% objective, replacing the sentence that the Committee expects inflation to return to its 2% objective. So a little less certain about the outcome of their fight against inflation, but even more determined. Or is this just desperation? Ironically, the FOMC said that overall economic activity appears to have picked up after edging down in the first quarter, while on the same day the Atlanta Fed revised its GDPNow-cast for Q2 downward to 0.0%. The FOMC did downgrade its GDP forecast for 2022 to 1.7% from 2.8%. But at the press conference Powell said he saw no sign of a broader slowdown in the economy. Well, if the Atlanta Fed’s nowcast is right, following -1.5% GDP growth in Q1 this means that US GDP contracted in the first half of this year. Technically not a recession if Q2 GDP growth remains non-negative, but still. This underlines the current divergence between GDP and the labor market, with the first pointing to stagnation and the second still showing solid growth. Fortunately for the US, the labor market data are more important to the NBER that formally dates business cycles.

Upward shift in dot plot, landing a little lest soft

The FOMC also published an update of their economic and rate projections. Back in March, the FOMC participants expected the target range for the federal funds rate to reach a midpoint of 1.9% by the end of 2022 and 2.8% before the end of 2023. However, even with the forward guidance that the Fed provided until early this week, the federal funds rate would have reached the March projection for the end of 2022 as soon as in July. So an upward shift was necessary.

In the new dot plot, the midpoint for the federal funds rate is 3.4% at the end of 2022, 3.8% at the end of 2023, and 3.4% again at the end of 2024. The median for the neutral rate rose from 2.4% in March to 2.5% in June, back to where it was in December. This means the FOMC intends to go above neutral before the end of 2022 and peak before the end of 2023, ending 2023 at 3.8%. In 2024 they expect to cut rates back to 3.4%, which is still well above neutral. So the FOMC seems to have upgraded its peak rate by a full percentage point, while hardly changing its neutral rate. This means that they expect to go deeper into restrictive territory to bring inflation back to target.

Interestingly, the PCE forecasts for 2023 and 2024 did not change very much with PCE inflation at 2.2% in the final quarter of 2024. So the FOMC thinks the rate hikes will be enough to get inflation back toward target, after 5.2% in the final quarter of 2022. Note that in April the PCE deflator stood at 6.3%.

The GDP and unemployment data show that the FOMC still expects a soft landing with annual GDP growth not lower than 1.7% in 2022-2024 and unemployment rising to only 4.1% by the final quarter of 2024. (At present unemployment is 3.6%). However, it is still a little less soft than anticipated in March when they thought unemployment would be 3.6% in 2024 and GDP growth substantially higher in 2022-2024.

Balance sheet remains on auto-pilot

The FOMC made no change to the balance sheet normalization schedule. Balance sheet reduction finally started on June 1, well over a year since inflation started to skyrocket. Balance sheet reduction will – after a three month adjustment period – take place through monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS. This process started in June with a smaller $30 billion cap for Treasury securities and $17.5 billion cap for agency debt and agency MBS

Balance sheet reduction is on auto-pilot for now, but a decision about the sales of agency MBS will be needed somewhere along the way. According to the minutes of the May meeting, a number of participants remarked that, after balance sheet runoff was well under way, it would be appropriate for the Committee to consider sales of agency MBS to enable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities. Any program of sales of agency MBS would be announced well in advance.

75 not the new 50, but maybe again next time

During the Q&A Powell had to explain why the FOMC had abandoned its forward guidance of 50 bps. Powell said that the higher than expected CPI print on Friday, but also the upward move in long-term inflation expectations in the University of Michigan survey (see our otherwise irrelevant preview for more details about these data), warranted a 75 bps hike. He said he’d like to think that the Fed’s guidance is still credible and that it is very unusual to get such data during the blackout period. He did not expect 75 bps to be common, but he also said that a 50 to 75 bps move was most likely at the next meeting.

Powell said that the Committee expected the federal funds rate to be at a modestly restrictive level of 3.0-3.5% at the end of this year, followed by more tightening next year to 3.5-4.0%. When asked about a softish landing he pointed at the projections meeting that test, and he said that he did believe the Fed can do that. But he added that there is now a bigger chance that it depends on other factors. Powell also said the Fed was not trying to induce a recession.

Conclusion

Today the Fed tried to appear on top of things by raising the target range for the federal funds rate by 75 bps. Still, the outsized impact of a single higher than expected CPI print suggests otherwise. Since the Fed is still underestimating the inflation problem, with peak inflation the new transitory, not recognizing that a wage-price spiral has already started, we expect they will have to raise rates faster than they now expect. We expect the target range to reach 3.75-4.00%, as soon as in December. Below our forecasts for the remaining FOMC meetings of this year. However, please keep in mind that the actual course will be highly data dependent as we have seen this month.

Unfortunately, the hiking path is also likely to be followed by a recession, which we still expect to occur in the second half of 2023. As we explained in The inevitable recession, if the US economy manages to survive the onslaught of negative supply shocks (see our remarks about GDPNow above), then the Fed will finish the job because they have to squeeze out inflation. Powell said that he expects a soft landing and that the Fed is not trying to induce a recession. He also denied that there is a wage-price spiral in the US. In contrast, we think the wage-price spiral has already started, which can only be terminated by a recession.