The post-covid tailwind for big box retailers is officially dead and buried and the hangover is officially here.

After reporting quarter after quarter of blowout earnings in the post-covid world, moments ago the largest US non-online retailer, WalMart saw its stock plunge after reporting an ugly quarter, one in which it missed earnings despite handily beating on the top line, and more importantly, cut EPS guidance after warning that inflation is eating into its profit margins.

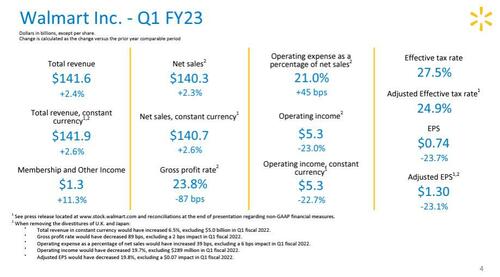

First, this is what WalMart reported for Q1:

- Revenue $141.57 billion, +2.4% y/y, beating the estimate $139.09 billion

- Adjusted EPS $1.30, down 23.7% vs. $1.69 y/y, and missing the estimate $1.48

- Total U.S. comparable sales ex-gas +4%, beating estimate +2.26% (2-year same store sales stack +9%, estimate +7.66%)

- Walmart-only U.S. stores comparable sales ex-gas +3%, beating estimate +2.04%

- Sam’s Club U.S. comparable sales ex- gas +10.2%, beating estimate +5.02%

- Walmart-only U.S. comparable ticket +3%, beating estimate +1.48% (2 estimates)

- Change in U.S. E-Commerce sales +1%, missing estimate +1.84%

- Adjusted operating income in constant currency $792 million, missing estimate $917.7 million

A mixed picture but hardly catastrophic and largely in line with expectations: the Bentonville, AR based company, which has championed “everyday low prices,” is suddenly finding it very difficult to stick to its motto while vying for more customers as inflation prompts shoppers to look harder for bargains. But soaring costs for merchandise, transportation and labor are clearly eating into the company's profitability, and nowhere was that more evident than in the company's guidance.

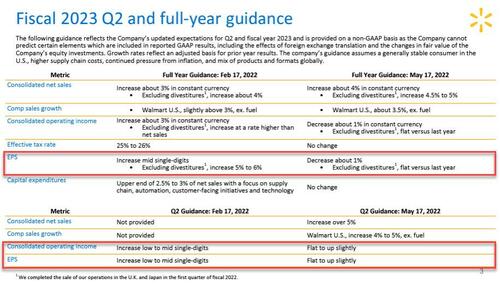

The retailer now sees earnings per share falling by about 1% this year, compared with a prior view of mid-single-digit gains, Walmart said in an unexpected guidance cut taking place so early on in the year. For the current quarter, Walmart said it now expects earnings to be “flat to up slightly” compared with a prior view of a low- to mid-single-digit increase.

The culprit behind the unexpected guidance cut? Inflation, of course: “US inflation levels, particularly in food and fuel, created more pressure on margin mix and operating costs than we expected,” Walmart Chief Executive Officer Doug McMillon said in the statement. “We’re adjusting and will balance the needs of our customers for value with the need to deliver profit growth for our future.”

WMT stock plunged as much as 7% in early trading New York time. Walmart had gained 2.4% so far this year through Monday, bucking a selloff of US stocks.

As Bloomberg notes, the disappointing performance underscores the pressure on US consumers as soaring prices send sentiment to the lowest in a decade. Walmart and other retailers are also contending with the end of stimmies after benefiting in early 2021 from an injection of federal spending to help households weather the coronavirus pandemic.

The retailer is also trying to develop businesses in digital advertising, financial services and health care, and it’s investing heavily in online sales. However, the process is not going quite as hot as desired, and E-commerce grew only 1% in the quarter. The online business got a substantial boost during pandemic lockdowns, but demand has been slowing as shoppers venture back into stores.

The full Q1 earnings presentation is below (pdf link)

The post-covid tailwind for big box retailers is officially dead and buried and the hangover is officially here.

After reporting quarter after quarter of blowout earnings in the post-covid world, moments ago the largest US non-online retailer, WalMart saw its stock plunge after reporting an ugly quarter, one in which it missed earnings despite handily beating on the top line, and more importantly, cut EPS guidance after warning that inflation is eating into its profit margins.

First, this is what WalMart reported for Q1:

- Revenue $141.57 billion, +2.4% y/y, beating the estimate $139.09 billion

- Adjusted EPS $1.30, down 23.7% vs. $1.69 y/y, and missing the estimate $1.48

- Total U.S. comparable sales ex-gas +4%, beating estimate +2.26% (2-year same store sales stack +9%, estimate +7.66%)

- Walmart-only U.S. stores comparable sales ex-gas +3%, beating estimate +2.04%

- Sam’s Club U.S. comparable sales ex- gas +10.2%, beating estimate +5.02%

- Walmart-only U.S. comparable ticket +3%, beating estimate +1.48% (2 estimates)

- Change in U.S. E-Commerce sales +1%, missing estimate +1.84%

- Adjusted operating income in constant currency $792 million, missing estimate $917.7 million

A mixed picture but hardly catastrophic and largely in line with expectations: the Bentonville, AR based company, which has championed “everyday low prices,” is suddenly finding it very difficult to stick to its motto while vying for more customers as inflation prompts shoppers to look harder for bargains. But soaring costs for merchandise, transportation and labor are clearly eating into the company’s profitability, and nowhere was that more evident than in the company’s guidance.

The retailer now sees earnings per share falling by about 1% this year, compared with a prior view of mid-single-digit gains, Walmart said in an unexpected guidance cut taking place so early on in the year. For the current quarter, Walmart said it now expects earnings to be “flat to up slightly” compared with a prior view of a low- to mid-single-digit increase.

The culprit behind the unexpected guidance cut? Inflation, of course: “US inflation levels, particularly in food and fuel, created more pressure on margin mix and operating costs than we expected,” Walmart Chief Executive Officer Doug McMillon said in the statement. “We’re adjusting and will balance the needs of our customers for value with the need to deliver profit growth for our future.”

WMT stock plunged as much as 7% in early trading New York time. Walmart had gained 2.4% so far this year through Monday, bucking a selloff of US stocks.

As Bloomberg notes, the disappointing performance underscores the pressure on US consumers as soaring prices send sentiment to the lowest in a decade. Walmart and other retailers are also contending with the end of stimmies after benefiting in early 2021 from an injection of federal spending to help households weather the coronavirus pandemic.

The retailer is also trying to develop businesses in digital advertising, financial services and health care, and it’s investing heavily in online sales. However, the process is not going quite as hot as desired, and E-commerce grew only 1% in the quarter. The online business got a substantial boost during pandemic lockdowns, but demand has been slowing as shoppers venture back into stores.

The full Q1 earnings presentation is below (pdf link)