Authored by Scott Hill via BombThrower.com,

If you’ve seen the film “Die Hard” you’ll notice the villain is trying to steal strange assets called Bearer Bonds. Why did this entire asset class disappear from the modern financial landscape?

Which properties of these long forgotten assets are important for the future the Crypto industry is trying to build? Why did governments around the world outlaw the Bearer Asset in the first place?

History of the Bearer Asset

Until the 1980s, bearer assets were very common. Bonds would be issued on paper and bondholders would present the instruments physically to receive payment. In fact the paper certificates would often have small tear off sections that were redeemable for interest payments. This record keeping mechanism is why we still call the interest payments from Bonds, “coupons”.

In the pre-digital era assets could be represented in two ways:

Registered instruments, where every owner was recorded in a centralized registry. Transfers would be executed by a contract that was then “stamped” by the registrar. This would enable a verifiable list of owners to be kept and checked as necessary. Usually for taxation purposes or so that banks could be aware of who the true owners of a company seeking financial services were.

Then there were bearer assets.

Bearer assets were owned by whoever held them. They could be bought and sold by physically transferring the document. There was no registry of owners.

This wasn’t some niche quirky asset class. Some of the most important companies in history issued bearer stock, like the Mississippi company, formed in 1717 and responsible for the infamous “Mississippi bubble”.

Most governments issued bearer bonds to fund themselves. In the United States for example if you wanted to claim an interest payment on your government bonds you would need to physically present the certificates at your local Federal Reserve building.

Bearer assets haven’t completely disappeared. Chances are if you open your wallet you still have some bearer assets in the form of your banknotes. They aren’t even from such a long time ago. The last US Government issued bearer bond only matured in 2016.

The Problems with Bearer Assets

Starting in the 1980s there was a concerted effort to eradicate bearer assets from the world. In a combined effort from FATF, the global anti-money laundering organization, and the US government, an agenda was pursued where all assets would become registered instruments. This would ensure that the owners of all assets could be known, taxed and tracked.

The problems for governments are fairly obvious. Assets that you can hold privately and anonymously are difficult to tax. Transfers that can occur between two people without any authority being notified can be used to launder money or evade capital controls.

There’s also the issue of counterfeiting. In 2009, over $130 billion in US government bearer bonds were uncovered by Italian customs officials. Without a central register modern printing techniques had made bearer instruments far too easy to counterfeit.

The practical issues are possibly more important for this analysis. Without a centralized authority to record ownership it’s difficult to develop the trust required to exchange assets between entities who don’t already have a business relationship.

Transfers are also slow compared with changing an entry in a computer database if you’re not in the same place as your counter-party. This problem is particularly noticeable if there isn’t a ready market for assets nearby. For example, in the 1900s it would be difficult to exchange bearer assets in Nebraska where there was no market, but relatively easy to do so in New York.

The Benefits of Bearer Assets

The need for a physical marketplace for bearer assets is a large part of the reason why financial hubs like New York, London and Amsterdam arose. Bearer assets could simply be handed over in exchange for cash so traders would congregate around the largest markets. Traders could exchange bearer assets as quickly as necessary without needing to stop and register each transaction. This ease of transfer was a significant financial innovation in earlier eras and could be credited for pushing forward capitalism itself by making corporate shares and bonds easily tradable assets.

Portability and usability were also significant features. In this previous era you might take a loan on your stock or bonds by physically depositing the certificates as collateral with a bank. If you needed to relocate countries your assets could easily move with you and be used in your new country without requiring any verification from the institutions in your previous homeland.

Bearer assets opened up the ability to perform global capitalism in a way that simply wasn’t possible before their invention. A stock certificate could be issued in Paris then transported to Amsterdam and traded at their stock exchange with ease. This did open up some strange issues with corporate governance however. Shareholders scattered throughout the globe are not easy to contact and gather for a shareholders meeting.

The Modern System

Now that bearer assets are all but wiped out, the modern asset system functions using a string of registries and a plethora of intermediaries. A modern stock certificate might be held digitally with the DTCC in New York, on trust for a German Holding company who then fractionalizes the share and sells those fractions to Robinhood who then sells those fractions to an investor.

Complicated, huh?

But it all works seamlessly thanks to digital communications systems and trust. The trust part is important. This entire system is held up by trust in other countries’ regulatory authorities. In the solvency of their financial institutions. In their systems.

It could all go away very quickly if that were no longer the case.

We already see what this world would look like by examining how emerging markets operate. Would you trust an Argentine stock registry to record your assets? How about an Iranian one?

Bitcoin Fixes This

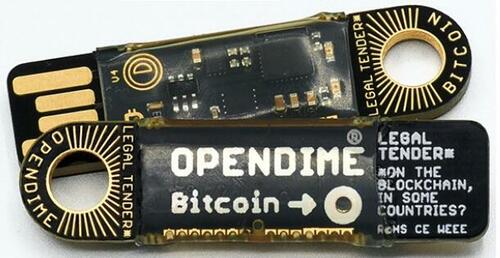

If we are heading into a fractured world as many analysts are predicting, we’ll need the return of bearer assets to keep capital markets functioning. Cryptocurrencies like Bitcoin represent the return of the bearer asset in the form of digital shared ledgers.

Just like old paper bearer assets, an individual can prove they own their digital assets directly, without the assistance and trust of intermediaries. They can simply sign using their wallet to confirm ownership of the assets held within.

People can transfer digital assets directly, globally, at near instant speeds.

This financial innovation is both extremely powerful but also extremely risky for the current institutions that exist primarily to provide trust and custody to assets.

Most people who haven’t gone down the Bitcoin rabbithole yet don’t really understand the paradigm shift that has happened with the invention of digital bearer assets. They can type an order into their stock trading app and to them that’s as good as Bitcoin’s near instant global settlement. They fail to see the fundamental difference.

Trading a stock on an online exchange relies on a huge number of intermediaries to execute the trade, to store the assets and to verify the existence of assets. If you hold a share of a company in the modern system it’s impossible to prove this fact directly. The best you can do is present a brokerage account statement and ask that your brokerage is trusted. This system of trust works fine in the functional modern world we have lived in for decades, but in a world where trust is fragmented and scarce, the ability to secure and prove your ownership of assets without asking permission may become invaluable.

Benefits of Digital Bearer Assets

Digital assets don’t have to only be useful assets for the end of the world. The ability to trade assets globally without the involvement of authorities and institutions means that unlike stocks, digital assets can tap global liquidity and allow capital formation to know no borders or class divides. It’s relatively easy for a rural Kenyan farmer to purchase a dollar worth of Bitcoin. It’s nearly impossible for the same person to acquire a dollar worth of Amazon stock.

There’s also the nature of blockchain infrastructure to consider. The entire premise of token based blockchains is that they are financial ecosystems that utilize tokens to represent ownership. This allows blockchain systems to achieve near instant financial functions with final settlement. A fundamentally different experience to using something like the Visa network which can take days to settle. A merchant would then need to ask permission from their bank to utilize those funds again after that long lag time.

Ensuring that ownership of tokens is directly verifiable and transferable by users is fundamental to using blockchains to power finance. Blockchains would not be a useful innovation with bloated middlemen getting in between transactions and adding the same delays that we currently experience.

The design of cryptocurrencies with open ledgers that are verifiable by anyone also removes some of the issues with old paper bearer assets. Tokenholders can be identified and contacted significantly more easily than the holders of paper assets. It would even be easier than the methods used under the current system of share registries and chains of intermediaries holding assets on behalf of others. This tangled web of ownership often leads to shareholder voting being an impossible to coordinate task. Instead asset holding mega-firms like Blackrock vote on behalf of all of their clients. Digital bearer assets could be a path back to functional shareholder coordination and governance.

Return to Capitalism

Digital assets fundamentally change the nature of assets back to something that looks more like traditional capitalism, where individual asset owners can pool capital directly and efficiently. Where people can truly own assets, not just be granted access to asset markets by intermediaries.

The ramifications of this increase of speed and global access to finance are staggering. We’ve really only seen the first stages of what this technology can enable.

There will be growing pains along the way. Governments and institutions will need to adapt to this paradigm shift. Just like bearer instruments unlocked the power of capitalism in the 18th century, digital bearer instruments could do the same for the 21st century.

Authored by Scott Hill via BombThrower.com,

If you’ve seen the film “Die Hard” you’ll notice the villain is trying to steal strange assets called Bearer Bonds. Why did this entire asset class disappear from the modern financial landscape?

Which properties of these long forgotten assets are important for the future the Crypto industry is trying to build? Why did governments around the world outlaw the Bearer Asset in the first place?

History of the Bearer Asset

Until the 1980s, bearer assets were very common. Bonds would be issued on paper and bondholders would present the instruments physically to receive payment. In fact the paper certificates would often have small tear off sections that were redeemable for interest payments. This record keeping mechanism is why we still call the interest payments from Bonds, “coupons”.

In the pre-digital era assets could be represented in two ways:

Registered instruments, where every owner was recorded in a centralized registry. Transfers would be executed by a contract that was then “stamped” by the registrar. This would enable a verifiable list of owners to be kept and checked as necessary. Usually for taxation purposes or so that banks could be aware of who the true owners of a company seeking financial services were.

Then there were bearer assets.

Bearer assets were owned by whoever held them. They could be bought and sold by physically transferring the document. There was no registry of owners.

This wasn’t some niche quirky asset class. Some of the most important companies in history issued bearer stock, like the Mississippi company, formed in 1717 and responsible for the infamous “Mississippi bubble”.

Most governments issued bearer bonds to fund themselves. In the United States for example if you wanted to claim an interest payment on your government bonds you would need to physically present the certificates at your local Federal Reserve building.

Bearer assets haven’t completely disappeared. Chances are if you open your wallet you still have some bearer assets in the form of your banknotes. They aren’t even from such a long time ago. The last US Government issued bearer bond only matured in 2016.

The Problems with Bearer Assets

Starting in the 1980s there was a concerted effort to eradicate bearer assets from the world. In a combined effort from FATF, the global anti-money laundering organization, and the US government, an agenda was pursued where all assets would become registered instruments. This would ensure that the owners of all assets could be known, taxed and tracked.

The problems for governments are fairly obvious. Assets that you can hold privately and anonymously are difficult to tax. Transfers that can occur between two people without any authority being notified can be used to launder money or evade capital controls.

There’s also the issue of counterfeiting. In 2009, over $130 billion in US government bearer bonds were uncovered by Italian customs officials. Without a central register modern printing techniques had made bearer instruments far too easy to counterfeit.

The practical issues are possibly more important for this analysis. Without a centralized authority to record ownership it’s difficult to develop the trust required to exchange assets between entities who don’t already have a business relationship.

Transfers are also slow compared with changing an entry in a computer database if you’re not in the same place as your counter-party. This problem is particularly noticeable if there isn’t a ready market for assets nearby. For example, in the 1900s it would be difficult to exchange bearer assets in Nebraska where there was no market, but relatively easy to do so in New York.

The Benefits of Bearer Assets

The need for a physical marketplace for bearer assets is a large part of the reason why financial hubs like New York, London and Amsterdam arose. Bearer assets could simply be handed over in exchange for cash so traders would congregate around the largest markets. Traders could exchange bearer assets as quickly as necessary without needing to stop and register each transaction. This ease of transfer was a significant financial innovation in earlier eras and could be credited for pushing forward capitalism itself by making corporate shares and bonds easily tradable assets.

Portability and usability were also significant features. In this previous era you might take a loan on your stock or bonds by physically depositing the certificates as collateral with a bank. If you needed to relocate countries your assets could easily move with you and be used in your new country without requiring any verification from the institutions in your previous homeland.

Bearer assets opened up the ability to perform global capitalism in a way that simply wasn’t possible before their invention. A stock certificate could be issued in Paris then transported to Amsterdam and traded at their stock exchange with ease. This did open up some strange issues with corporate governance however. Shareholders scattered throughout the globe are not easy to contact and gather for a shareholders meeting.

The Modern System

Now that bearer assets are all but wiped out, the modern asset system functions using a string of registries and a plethora of intermediaries. A modern stock certificate might be held digitally with the DTCC in New York, on trust for a German Holding company who then fractionalizes the share and sells those fractions to Robinhood who then sells those fractions to an investor.

Complicated, huh?

But it all works seamlessly thanks to digital communications systems and trust. The trust part is important. This entire system is held up by trust in other countries’ regulatory authorities. In the solvency of their financial institutions. In their systems.

It could all go away very quickly if that were no longer the case.

We already see what this world would look like by examining how emerging markets operate. Would you trust an Argentine stock registry to record your assets? How about an Iranian one?

Bitcoin Fixes This

If we are heading into a fractured world as many analysts are predicting, we’ll need the return of bearer assets to keep capital markets functioning. Cryptocurrencies like Bitcoin represent the return of the bearer asset in the form of digital shared ledgers.

Just like old paper bearer assets, an individual can prove they own their digital assets directly, without the assistance and trust of intermediaries. They can simply sign using their wallet to confirm ownership of the assets held within.

People can transfer digital assets directly, globally, at near instant speeds.

This financial innovation is both extremely powerful but also extremely risky for the current institutions that exist primarily to provide trust and custody to assets.

Most people who haven’t gone down the Bitcoin rabbithole yet don’t really understand the paradigm shift that has happened with the invention of digital bearer assets. They can type an order into their stock trading app and to them that’s as good as Bitcoin’s near instant global settlement. They fail to see the fundamental difference.

Trading a stock on an online exchange relies on a huge number of intermediaries to execute the trade, to store the assets and to verify the existence of assets. If you hold a share of a company in the modern system it’s impossible to prove this fact directly. The best you can do is present a brokerage account statement and ask that your brokerage is trusted. This system of trust works fine in the functional modern world we have lived in for decades, but in a world where trust is fragmented and scarce, the ability to secure and prove your ownership of assets without asking permission may become invaluable.

Benefits of Digital Bearer Assets

Digital assets don’t have to only be useful assets for the end of the world. The ability to trade assets globally without the involvement of authorities and institutions means that unlike stocks, digital assets can tap global liquidity and allow capital formation to know no borders or class divides. It’s relatively easy for a rural Kenyan farmer to purchase a dollar worth of Bitcoin. It’s nearly impossible for the same person to acquire a dollar worth of Amazon stock.

There’s also the nature of blockchain infrastructure to consider. The entire premise of token based blockchains is that they are financial ecosystems that utilize tokens to represent ownership. This allows blockchain systems to achieve near instant financial functions with final settlement. A fundamentally different experience to using something like the Visa network which can take days to settle. A merchant would then need to ask permission from their bank to utilize those funds again after that long lag time.

Ensuring that ownership of tokens is directly verifiable and transferable by users is fundamental to using blockchains to power finance. Blockchains would not be a useful innovation with bloated middlemen getting in between transactions and adding the same delays that we currently experience.

The design of cryptocurrencies with open ledgers that are verifiable by anyone also removes some of the issues with old paper bearer assets. Tokenholders can be identified and contacted significantly more easily than the holders of paper assets. It would even be easier than the methods used under the current system of share registries and chains of intermediaries holding assets on behalf of others. This tangled web of ownership often leads to shareholder voting being an impossible to coordinate task. Instead asset holding mega-firms like Blackrock vote on behalf of all of their clients. Digital bearer assets could be a path back to functional shareholder coordination and governance.

Return to Capitalism

Digital assets fundamentally change the nature of assets back to something that looks more like traditional capitalism, where individual asset owners can pool capital directly and efficiently. Where people can truly own assets, not just be granted access to asset markets by intermediaries.

The ramifications of this increase of speed and global access to finance are staggering. We’ve really only seen the first stages of what this technology can enable.

There will be growing pains along the way. Governments and institutions will need to adapt to this paradigm shift. Just like bearer instruments unlocked the power of capitalism in the 18th century, digital bearer instruments could do the same for the 21st century.